Global share markets had a volatile week with ongoing worries about banking contagion, but managed to rise helped by some settling of concerns in the US and hopes that central banks are near the top on rates. For the week US shares gained 1.4%, Eurozone shares rose 1% (despite a fall in Deutsche Bank shares on Friday), Japanese shares rose 0.2% and Chinese shares rose 1.7%. However, Australian shares remained under pressure falling by 0.6% for the week with falls led by property stocks, banks, IT and industrial shares. Bond yields mostly fell again. Oil and metal prices rose but the iron ore price fell. The $A fell despite a further fall in the $US.

Bank turmoil still providing a roller coaster ride for investors. The bad news is that:

- the risk of further contagion remains high in the short term particularly as rate hikes and last year’s surge in bond yields continues to feed through to other sectors of the economy, eg, office property is particularly vulnerable to the negative valuation impact of higher bond yields and reduced space demand from “work from home” which in turn will have an impact on banks;

- the US authorities have contributed to confusion over protection for bank deposits over $US250,000 with Treasury Secretary Yellen providing conflicting messages on this over three days reflecting the problems the US Administration has in extending protection without a backlash from Congressional Republicans;

- central banks have continued to raise interest rates – with multiple moves over the last week from the Fed, Bank of England, Swiss National Bank, Norway, the Philippines and Taiwan. The Fed tightening is unprecedented for a financial crisis. It does seem like central banks are determined to show that they have financial stability measures to deal with financial stability issues and so monetary policy is still free to deal with inflation; and

- the turmoil still implies a hit to growth – as a result of increased bank funding costs and reduced lending which could knock around -0.5% off GDP in the US & Europe – and hence profits.

However, the good news is that:

- the situation is nowhere near the broad-based bank asset problems that gave rise to the GFC (at least not yet);

- authorities in the US and Switzerland have moved quickly to limit contagion from problems in US regional banks and Credit Suisse;

- while the Swiss National Bank created uncertainty by wiping out the value of hybrid AT1 bail-in bonds issued by Credit Suisse, EU authorities have stated that bail-in bonds would rank ahead of equity in the EU;

- bank borrowing from the Fed has fallen back to around zero suggesting deposit outflows have stabilised;

- major central banks are taking account of the banking turmoils’ dampening impact on lending and hence economic activity and inflation which implies less interest rate hikes than otherwise and that central banks may be at or near the top; and

- so far there is little evidence of a surge in banking sector systemic risks – although it’s still early days.

The bottom line is so far so good, but history warns that the fallout from the monetary tightening of the last year still has a way to go yet including in terms of the impact on banks so volatility in share markets is likely to remain high for a while yet.

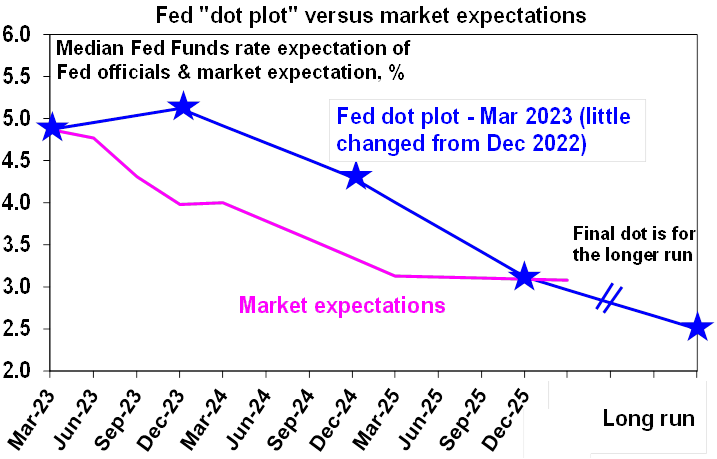

The Fed is likely nearly done. The Fed raised its key Fed Funds rate by another 0.25% taking it to a range of 4.75-5%, with an acknowledgement of the dampening impact on activity and inflation from the banking turmoil, a downgrade to its tightening guidance and no change to the peak dot which remains at 5-5.25% suggesting just one more hike. Fed Chair Powell’s press conference comments leaned more hawkish though, focussing on still high inflation and warning of more rate hikes and pushing back against market expectations for rate cuts this year. However, the overall impression is that while the Fed does not plan to cut interest rates to deal with banking sector liquidity issues (seeing last week’s banking backstop measures as dealing with that) it is taking account of its impact on the economy and inflation and so has adjusted to a less hawkish stance than was the case before the turmoil began when it was thinking of hiking by 0.5% and raising its peak interest rate guidance. With demand likely to slow further, unemployment likely to rise and inflation expected to fall further our view remains that the Fed is nearing the end of its tightening cycle. While the Fed does not currently see rate cuts this year, in contrast to market expectations, we are allowing for one cut in December.

Source: US Federal Reserve, Bloomberg, AMP

While the hikes by the Fed and other central banks over the last two weeks complicate things for the RBA they don’t mean that the RBA is now “locked in” to doing the same thing next month. Looking at the major central banks – while the ECB and Fed hiked again despite the banking turmoil it should be borne in mind that they dropped or toned-down hawkish guidance on rates as a result of the turmoil and only a few weeks ago the Fed was considering a 0.5% hike but only moved by 0.25%. The BoE was likely forced into another rate hike by the rebound in UK inflation in February and the SNB is still playing catch up to the ECB with a policy rate of just 1.5%. What’s more the RBA was already considering the case for a pause before the banking turmoil at a time when these other central banks were all expected to raise rates again.

The case for the RBA to pause at its next meeting remains strong…to avoid a Wile E. Coyote moment. After Governor Lowe two weeks ago indicated he is “open” to a pause in interest rate hikes in April, the minutes from the last RBA board meeting confirmed that a pause was on the table for the April meeting implying data for employment, inflation, retail sales and business surveys and developments in the global economy would be key determinants of this. In terms of the check list: February jobs data was on the strong side but probably no more than expected by the RBA; business conditions in the February NAB survey were still solid but slowing and business conditions PMIs for March were weak; we are still waiting for data on retail sales (28 March) and inflation (29 March); and global developments have been negative with the banking turmoil likely to drive reduced bank lending and higher bank funding costs adding to the increasing risk of global recession which would impact Australia via reduced export demand and a hit to confidence. As RBA Assistant Governor Kent pointed out, the lagged effect from higher interest rates is likely to take longer this time around due to the high proportion of fixed rate loans and excess saving buffers built up through the pandemic – which means that the impact of the past rate hikes could show up in a rush, much like it did in 1990 after rapid rate hikes in 1988 and 1989, resulting in a bit of a Wile E. Coyote moment for the economy. After the biggest and fastest rise in interest rates since the late 1980s, increasing evidence that growth is slowing and inflation has peaked and increasing threats to global growth from the global banking turmoil it makes sense for the RBA to have a pause in April to better assess the outlook and the lagged impact of hikes to date.

The money market continues to price in no rate hike in April and that rates have peaked with possible rate cuts later this year or early next. Our base case remains for the RBA to pause in April but it’s a very close call.

The threat of a slump in commercial property values. Lately there has been increasing talk of a slump in unlisted non-residential properties of 20% or so. Commercial property benefitted like other assets from the search for yield as interest rates and bond yields plunged in the decades into the pandemic providing a positive valuation effect. In fact, some seemed to see the asset class as a replacement for bonds in portfolios. However, its now vulnerable from the double whammy of higher bond yields driving a negative valuation effect at the same time as reduced space demand flowing from “work from home” in the case of office property and online retail in the case of retail property. An economic downturn on the back of higher interest rates would add to the threat. The experience of the early 1990s where office property valuations fell for three years in a row reflecting an oversupply from the late 1980s office building boom then made worse by recession which pushed vacancy rates to 20-30% warns that commercial property slumps can be long and drawn out.

The Mamas and the Papas. When I first heard their music, I thought the mix of folk and rock in a band with both female and male voices layered on top of and under each other and lush orchestrations was absolute magic. Still do. From 1966 to 1968 they produced four albums. While they are best known for their classics – California Dreaming and Monday, Monday – there are three songs that really stick out. Look Through My Window is about when Papa John and Michelle were going through a brief separation and he thought she was in California when in fact she was still nearby in Greenwich Village. Twelve Thirty relates to their move from New York where everything was “dark and dirty” to Laurel Canyon where people “say good morning and really mean it” which I reckon is a bit like where I live. And Safe In My Garden layers vocal lines from Michelle & Cass and then Denny relating to the safety of their garden where the perfume from a flower is “causing me to swoon” in contrast to protests in the streets (possibly the Sunset Strip Riots). They had one last album in 1971 to fulfil a record contract but by then much of the magic had been lost.

Economic activity trackers

Our Economic Activity Trackers were little changed in the last week but remain in a downtrend in the US and Australia and basically flat in Europe.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

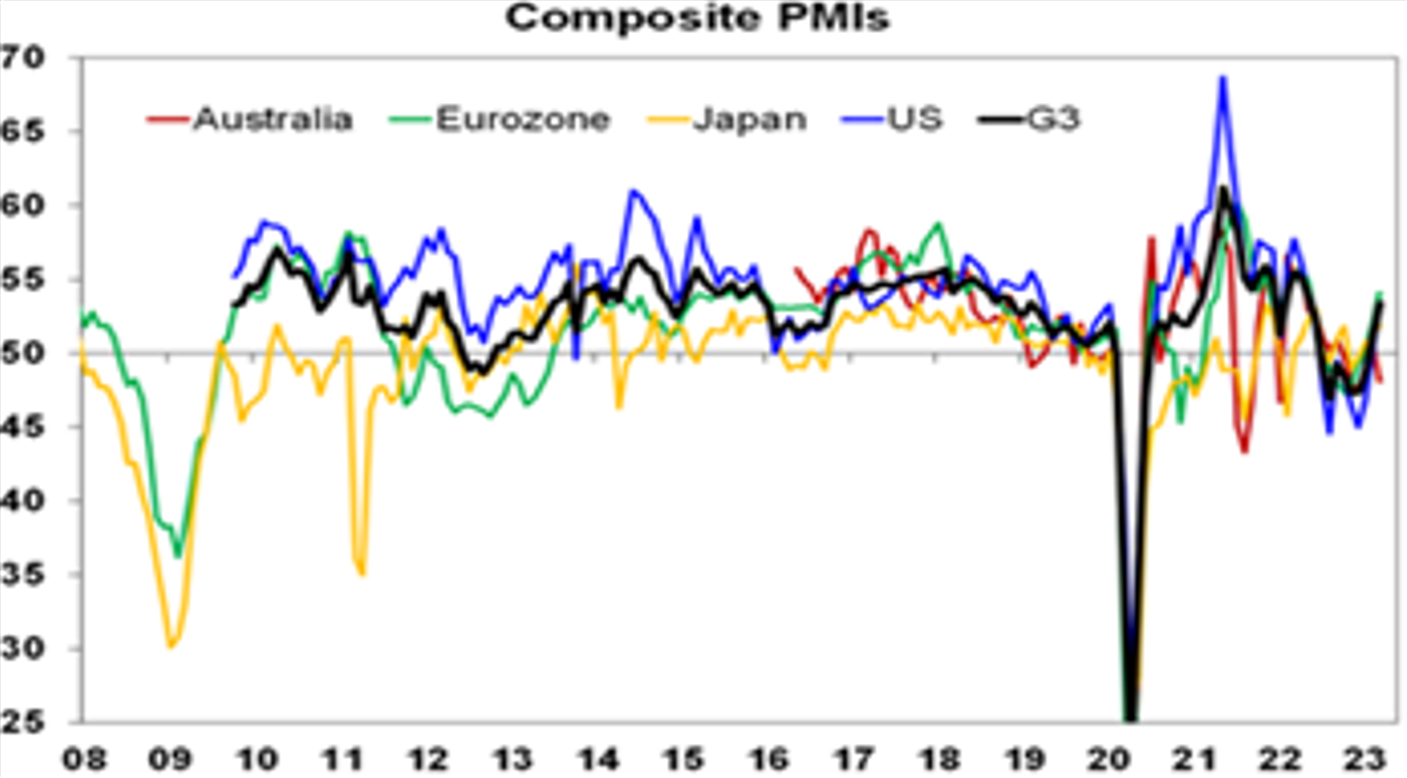

March composite business conditions PMIs in advanced countries were mostly stronger with the US, Europe and Japan all improving mainly on the back of stronger service sector conditions. The UK and Australia weakened though.

Source: Bloomberg, AMP

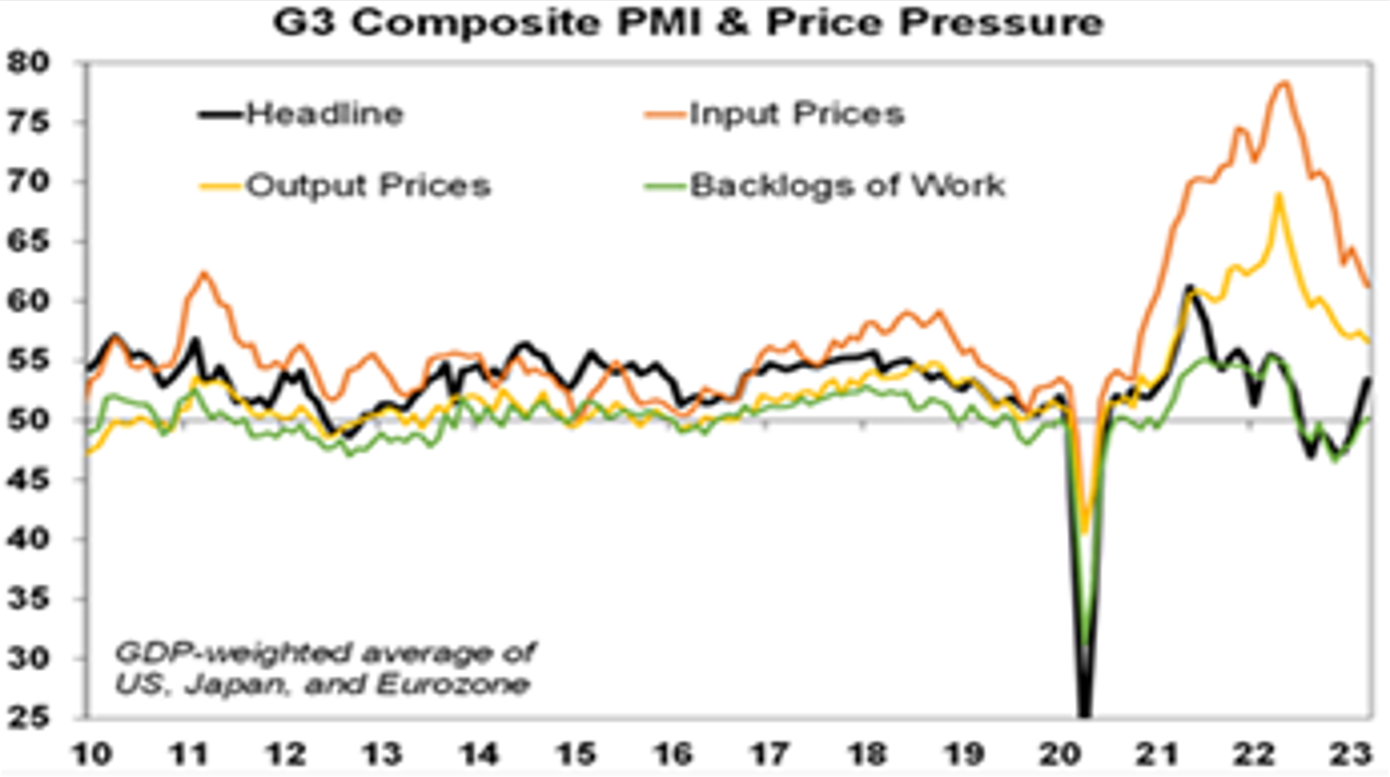

But inflation pressures continue to slow. The March PMIs averaged across major advanced countries showed a further easing in input and output price components, order backlogs running well below last year’s highs and substantially improved delivery times.

Source: Bloomberg, AMP

Apart from the PMIs, US economic data releases saw home sales rise, initial jobless claims remain low but softish durable goods orders with the latter pointing to soft March quarter business investment. Rising layoffs continue to point to an eventual rise in jobless claims though. On the inflation front the Philadelphia regional non-manufacturing survey showed sharp fall in wages and inflation pressures in the services sector.

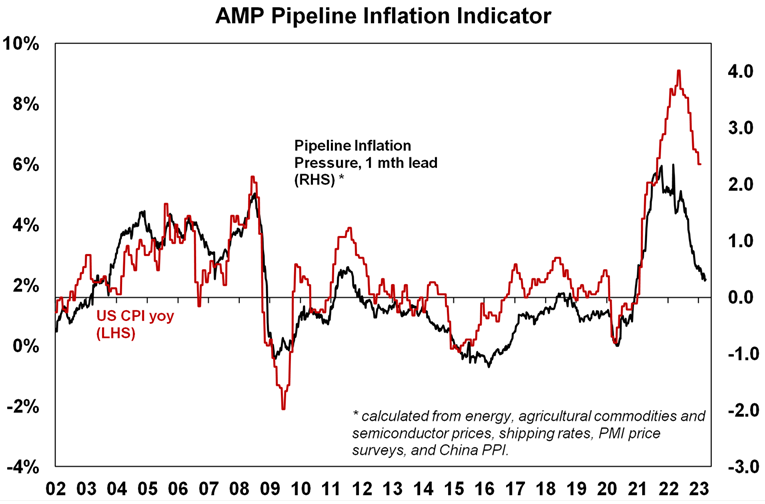

Our US Pipeline Inflation Indicator continues to point to lower US inflation ahead.

Source: Bloomberg, AMP

Canadian inflation for February fell more than expected to 5.2%yoy (down from a peak around 8% in mid last year) with underlying inflation falling to 4.8%. This supports the BoC’s decision to pause rate hikes.

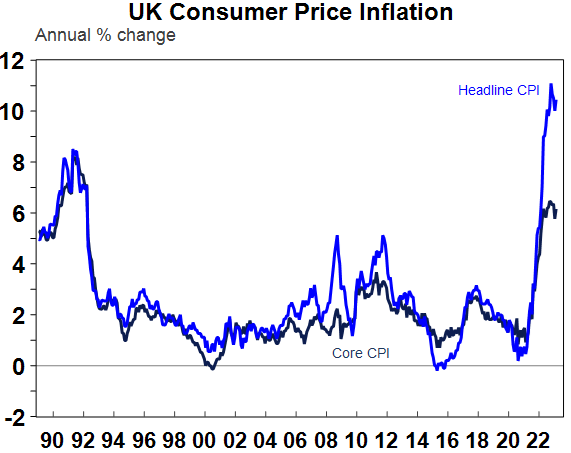

UK inflation though surprisingly rose to 10.4%yoy in February, with core inflation at 6.6%, partly explaining the further rate hike from the BoE in the last week.

Source: Macrobond, AMP

Japanese business conditions PMIs rose slightly in March to an okay 51.9. CPI inflation slowed to 3.3%yoy in February from 4.3% due to utility subsidies with core (ex food and energy) inflation rising slightly to 2.1% from 1.9%

Australian economic events and implications

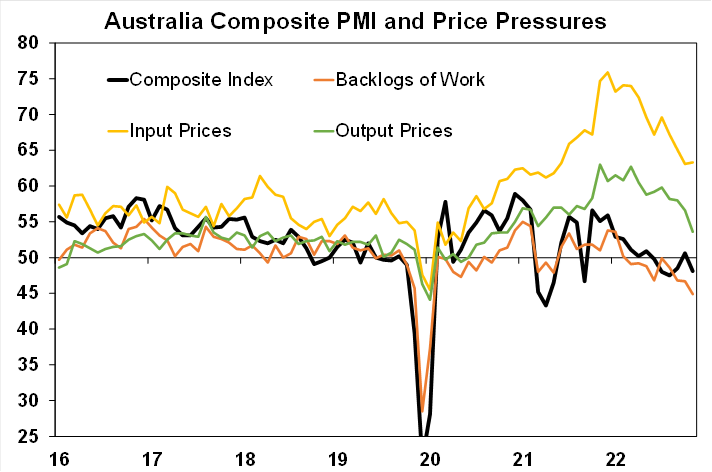

Australian business conditions PMIs for March showed a renewed fall to a soft reading of 48.1 led by weaker services sector conditions and weakness in new orders and employment. Input prices were little changed but remain well down from their high, output prices fell further and work backlogs continued to fall too all of which is consistent with easing inflation pressure.

Source: Bloomberg, AMP

What to watch over the next week?

US data in the week ahead is expected to show falls in consumer confidence and home prices (Tuesday) and in pending home sales (Wednesday), and a sharp slowdown in February personal spending growth with core personal consumption deflator inflation remaining unchanged at 4.7% (both due Friday).

Eurozone data on Friday is likely to show a slowing in headline CPI inflation for March to 7.5%yoy from 8.5%yoy but a further rise in core inflation to 5.8%yoy and flat unemployment.

Japanese data on Friday is likely to show continuing low unemployment and an improvement in industrial production.

Chinese business conditions PMIs for March (Friday) are likely to show continuing strength on the back of reopening.

In Australia, retail sales (Tuesday) and inflation (Wednesday) data for February will be watched closely as they are part of the RBA’s checklist ahead of considering a pause in rate hikes at its next meeting. We expect flat retail sales which will keep in place the flat nominal trend in retail sales since September and monthly inflation to show a further fall back to 6.9%yoy from 7.4%. Job vacancy data for February is likely to show the third quarter of falls in a row and private credit growth (Friday) is likely to show a further slowing in housing credit growth.

Outlook for investment markets

The year ahead is likely to see easing inflation pressures, central banks moving to get off the brakes and economic growth weakening but stronger than feared. This along with improved valuations should make for better returns than in 2022. But as we are seeing there will be bumps on the way – particularly regarding interest rates, recession risks, geopolitical risks and raising the US debt ceiling in the September quarter.

Global shares are expected to return around 7% this year. The post mid-term election year normally results in above average gains in US shares, but US shares are likely to be a relative underperformer compared to non-US shares reflecting still higher price to earnings multiples versus non-US shares. The $US is also likely to weaken further which should benefit emerging and Asian shares.

Australian shares are likely to outperform again, helped by stronger economic growth than in other developed countries and stronger growth in China supporting commodity prices and as investors continue to like the grossed-up dividend yield of around 5.5%.

Bonds are likely to provide returns a bit above running yields, as inflation slows and central banks become less hawkish.

Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of weaker share markets and last year’s rise in bond yields (on valuations). Commercial property returns are actually likely to be negative.

Australian home prices are likely to fall another 8% or so as rate hikes continue to impact, resulting in a top to bottom fall of 15-20%, but with prices expected to bottom around the September quarter, ahead of gains late in the year as the RBA moves toward rate cuts.

Cash and bank deposits are expected to provide returns of around 3.25%, reflecting the back up in interest rates.

A rising trend in the $A is likely over the next 12 months, reflecting a downtrend in the overvalued $US, the Fed moving to cut rates and solid commodity prices helped by stronger Chinese growth.

What you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.