Global share markets rose over the last week with US shares up helped by the debt ceiling deal and Fed signalling of a pause in rate hikes this month. For the week US shares rose 1.8%, Eurozone shares gained 0.04%, Japanese shares rose 2% and Chinese shares rose 0.3%. Australian shares fell 0.1% though with increasing expectations for further RBA rate hikes with falls led by consumer, financial and energy shares. Bond yields and the oil price fell but metal and iron ore prices rose as did the $A on the back of increased RBA rate hike expectations and a softer $US.

The suspension of the US debt ceiling out to January 2025 heads of a US Government default but also comes with some sting in the tail. The relative smoothness of the process compared to 2011 and 2013 is a positive sign in terms of the present workings of the US political system with President Biden and Speaker McCarthy proving far more willing to compromise than had been feared. However, just bear in mind that the spending caps for the next two years will imply around a 0.2-0.3% of GDP fiscal drag at a time when the US economy is already slowing. The resumption of bond issuance and rebuilding of Treasury’s deposit at the Fed will also reverse the liquidity boost that has been provided to markets by the Treasury running down its deposits since when it hit the ceiling in January.

With the debt ceiling issue out of the way, global and Australian shares continue to look vulnerable over the next few months. Share market gains since the lows last year have been narrowly based with the US share market flat this year were it not for a handful of tech stocks. Banking stress is continuing in fits and starts in the US resulting in additional monetary tightening. Leading economic indicators continue to point to a high risk of recession in the US and Australia. Fiscal austerity as part of the debt ceiling deal and the withdrawal of the liquidity injection by the US Treasury adds to this risk. China’s recovery is looking less robust. The weakness in copper, oil and other industrial commodities suggests weakening demand. Central banks are probably close to the top but risk doing more. And the period from May to September is often rough for shares. We remain of the view that shares will do okay on a 12-month view as central banks ease up as inflation cools but the next few months are likely to be rough. A fall in Eurozone inflation in May and the continuing decline in our US Pipeline Inflation Indicator are positive signs in this regard.

A rebound in Australian inflation and the latest minimum and award wage increases unfortunately now make a further RBA rate hike look likely and so we are allowing for another 0.25% increase in the cash rate on Tuesday taking it to 4.1%. Or if not on Tuesday, then in July. The money market now has priced a 42% chance of a 0.25% rate hike on Tuesday and an 80% chance by July.

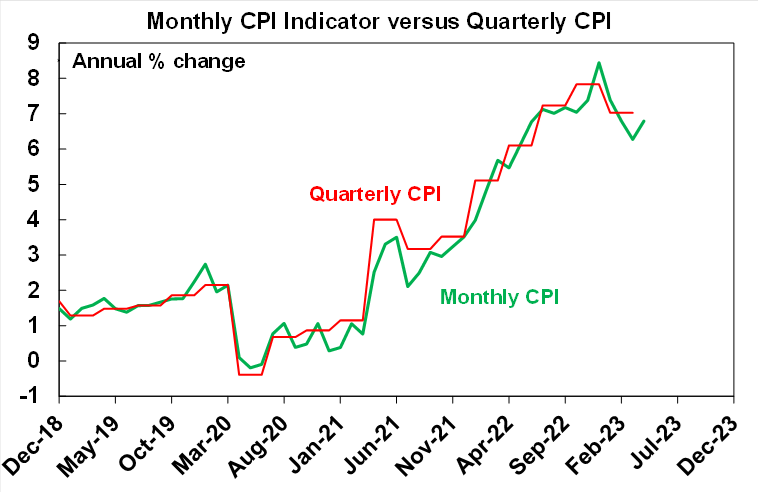

- The ABS’s Monthly Inflation Indicator rebounded to 6.8%yoy from 6.3%yoy. While this partly reflected base effects from the fuel excise cut a year ago (which will drop out in May), an Easter related surge in travel costs (which looks likely to reverse), seasonal considerations and monthly volatility the RBA will be concerned that inflation is too high.

Source: ABS, AMP

- The Fair Work Commission’s decision to increase award rates of pay by 5.75% and to realign the minimum wage to a higher award rate resulting in a de facto 8.65% increase in the minimum wage, all from 1 July, means a significant step up from last year’s increases of 4.6% in award wages and 5.2% in the minimum wage respectively. This will directly impact 0.7% of workers on the minimum wage and 20.5% of workers on awards and directly add about 0.26% to average wages growth. But given the influencing effect the wage case has on other wages (with widespread headlines of an 8.6% increase in the minimum wage), accelerating public sector wages growth, the 15% increase in aged care workers pay with a potential flow on to hospitality workers and the still tight labour market its looking increasingly likely that wages growth (now running at 3.7%yoy) will push beyond the 3 to 4% comfort zone.

- This is at a time when productivity is very poor adding to the risk of further upwards pressure on unit labour costs.

- This is likely all fuelling RBA concern – as evident in recent comments from Governor Lowe – that inflation will stay higher for longer and that inflation expectations will shift higher making it even harder to get back down. All of which points to the likelihood that the RBA will raise rates further to head this off.

- The trouble is that there are increasing signs that the economy is weakening – weak retail sales, a collapse in building approvals, slowing plans for growth in business investment and falling job openings. Sure, the economy is probably still growing but as we saw in the late 1980s tightening episode the economy was okay till it wasn’t. Key risks on this front are that a 4% plus cash rate will push debt servicing costs into record territory as a share of household income and on the RBA’s analysis 15% of households with a variable rate mortgage (which means about 1 million people) will be cash flow negative by year end at 3.75% cash rate and we are now going well beyond this.

- Our assessment is that inflation will slow rapidly as the economy cools and our Australian Pipeline Inflation Indicator points to a sharp fall in inflation ahead. But it’s looking increasingly doubtful that it will come quickly enough for the RBA as it will have moved rates up again before it arrives.

So following the April inflation data and the further step in minimum and award wages growth, the risk is now very high that ongoing inflation and wages concerns will see the RBA overtighten and knock the economy off the “narrow path” – between tightening too little and tightening too much that Governor Lowe has been referring to – into recession.

Economic activity trackers

Our Economic Activity Trackers fell in Australia, the US and Eurozone over the last week. Europe seems to be more decisively losing momentum now and the US remains quite week.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

US economic data over the past week was mixed. Payrolls rose a far stronger than expected 339,000 in May but household employment fell by 310,000 with falls in self-employment suggesting that while firm level employment as captured in payrolls remains strong self-employment may be weakening. Meanwhile unemployment rose to 3.7% and growth in average hourly earnings slowed to 4.3%yoy. Other jobs data was also mixed with job openings up in April, layoffs down and jobless claims up only slightly, but people quitting their jobs for new jobs fell and a survey by Challenger showed very low hiring with the overall picture suggesting that the jobs market is cooling but it’s still tight. Consumer confidence fell slightly in May, manufacturing conditions in the ISM survey and in the Dallas and Chicago regions were weak and home prices rose in March. Meanwhile, Fed Vice Chair designate Jefferson signalled that the Fed is not planning to raise rates in June but that a pause would not necessarily mean that it has reached the top. The mixed jobs data seen in the last week probably doesn’t change this with markets pricing in just a 12% chance of a 0.25% rate hike in June but a 64% chance of a hike in July.

Source: Macrobond, AMP

Canadian March quarter GDP growth came in a stronger than expected at 3.1%annualised or 1.7%yoy increasing the risk that the BoC may raise rates again at its meeting on Thursday.

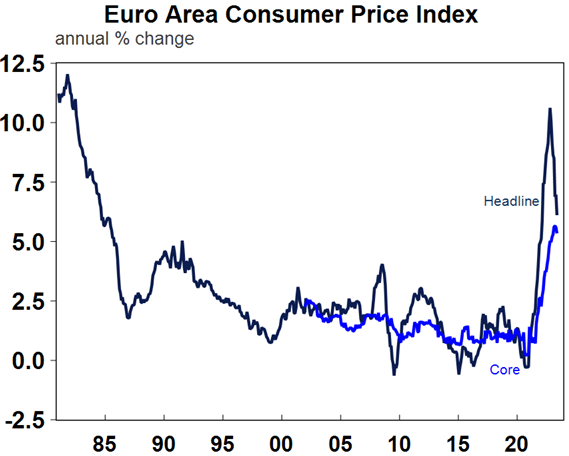

Eurozone CPI inflation fell more than expected in May to 6.1%yoy from 7%yoy with core inflation falling to 5.3%yoy from 5.6%yoy. The fall in inflation takes a bit of pressure of the ECB but its likely to remain hawkish for now with another hike this month. Meanwhile, unemployment was flat in April at 6.5% but confidence fell in May with broad based falls in business confidence and money supply and bank lending growth are slowing consistent with the ECB getting traction.

Source: Macrobond, AMP

Japanese unemployment fell in April and consumer confidence rose, but industrial production, retail sales and housing starts fell.

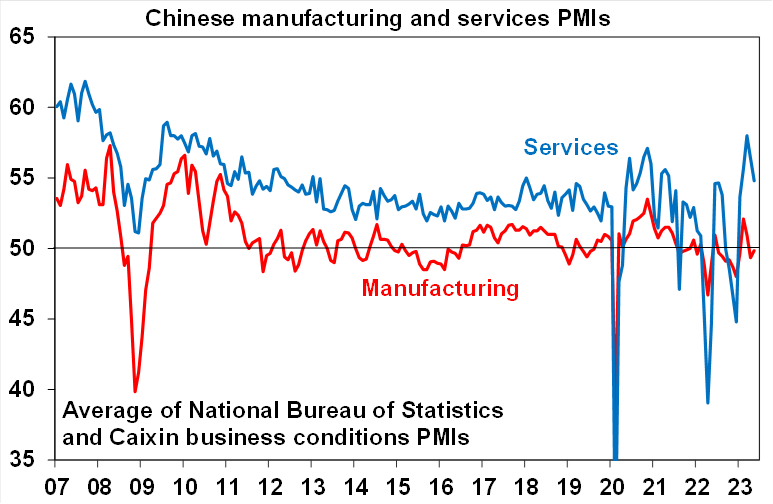

Chinese May business conditions PMIs were mostly soft with weak manufacturing conditions (with the official manufacturing PMI showing a fall but the Caixin PMI up). Overall, this adds to concerns that the Chinese recovery is weaker than expected particularly in manufacturing which in turn partly explains the ongoing weakness in industrial commodity prices.

Source: Bloomberg, AMP

Against this, India’s economic growth is surprising on the upside with GDP up 6.1% over the year to the March quarter and its manufacturing PMI rose to a 31 month high.

Australian economic events and implications

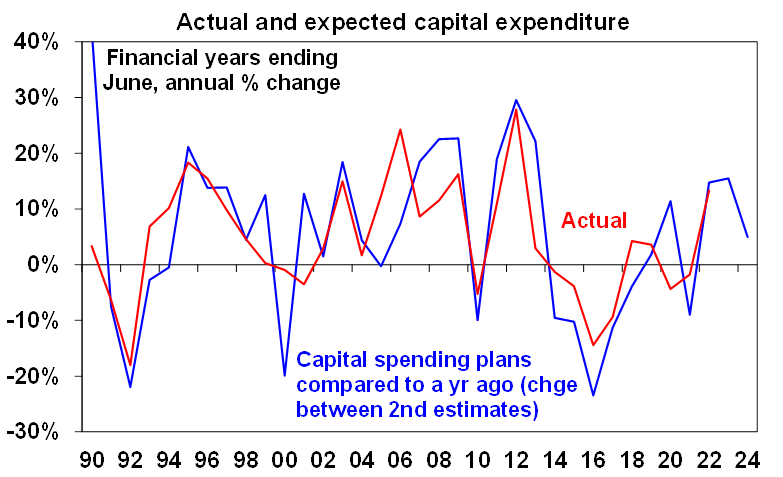

Australian economic data was mixed. March quarter construction and business investment data both rose more than expected and will support March quarter GDP growth. However, business investment plans for the year ahead point to a slowing in nominal growth to around 5% from 10.8% three months ago and from around 14% for this financial year. In real terms it might even be close to zero.

Source: ABS, AMP

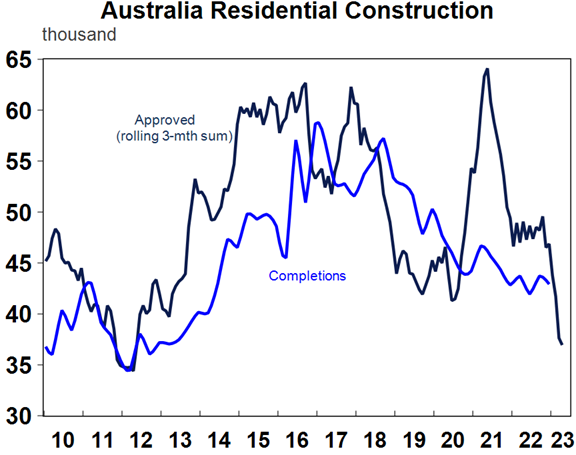

Residential building approvals plunged another 8.1% in April to now being at an 11-year low. While home building is being supported at present by a big pipeline of approvals yet to be completed the continuing plunge in approvals point to a sharp fall at some point ahead. This will accentuate the housing shortage.

Source: Macrobond, AMP

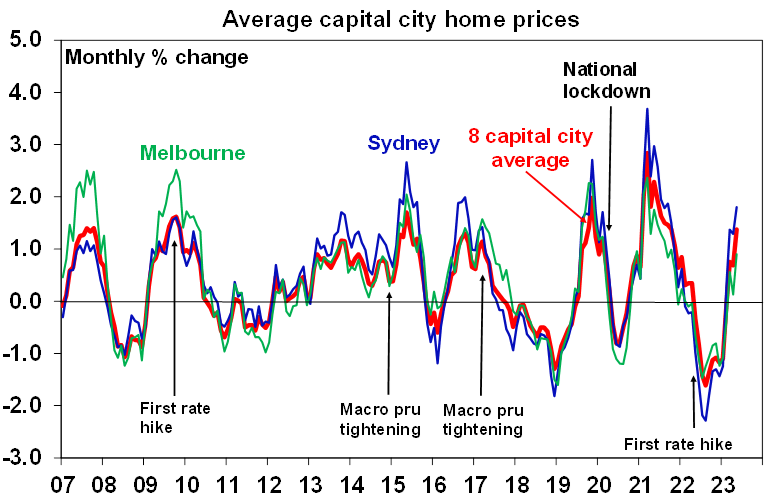

CoreLogic data showed that average home prices rose for the third month in a row in May with the gain accelerating to 1.2%mom with prices now up by 2.3% from their low. The rebound in underlying demand, the supply shortfall and now an element of FOMO are clearly dominating higher interest rates. Our base case is that prices have bottomed but the risk of another leg down is high particularly if the RBA continues to raise interest rates resulting in a recession with much higher unemployment.

Source: CoreLogic, AMP

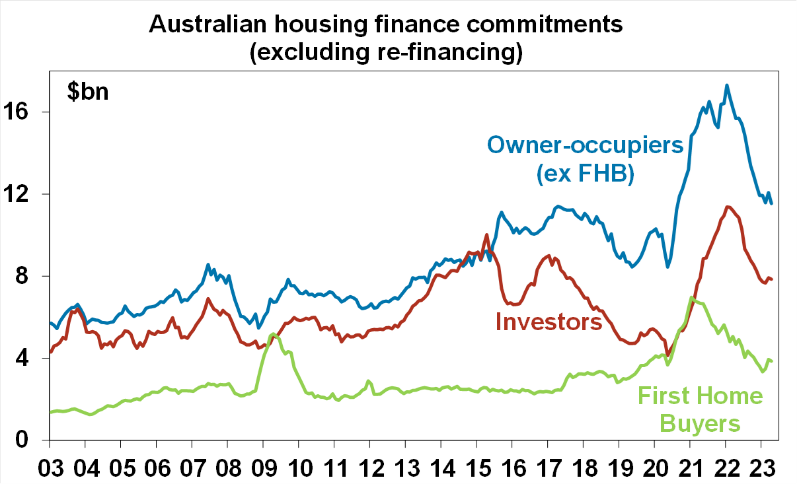

Housing credit growth saw a small uptick in April but housing finance commitments surprisingly fell across owner occupiers and investors. However, the fall for owner occupiers was in finance approvals for new construction with finance for established homes up 0.6%mom.

Source: ABS, AMP

What to watch over the next week?

In the US, the ISM services conditions index for May (Monday) is likely to remain okay at around 52.

The Bank of Canada (Wednesday) is expected to leave its key policy interest rate on hold at 4.5%, although the risks are on the side of another 0.25% hike.

Chinese trade data (Wednesday) will likely show slowing in export growth and still falling imports and CPI inflation for May (Friday) is likely to remain weak at just 0.2%yoy.

In Australia, as noted earlier we now expect the RBA to raise the cash rate by another 0.25% on Tuesday taking it to 4.1%. Our assessment remains that the RBA has already done enough to slow the economy and bring inflation back to target and we are now seeing clear evidence of slowing demand in terms of falling real retail sales, falling building approvals, slowing plans for growth in business investment and early indications of a slowing jobs market. As such we think the RBA should leave rates on hold and allow more time to assess the impact of past rate hikes. But the RBA’s hawkish bias, still high inflation and the rising impetus to wages growth – particularly flowing from the minimum and award wage increases – threatening to take it beyond levels consistent with the inflation target all point to the RBA raising rates again. It’s a close call but with an assessed 60% probability we are now allowing for another rate hike on Tuesday, and if not then in July. As noted earlier, the risk is now very high that the RBA will hike rates too far and knock the economy off the “narrow path” into recession. Whether the RBA hikes on Tuesday or not its guidance is likely to remain hawkish and Governor Lowe will likely provide an update on the RBA’s views at a speech on Wednesday.

Another 0.25% rate hike will mean an extra $100 a month in additional debt servicing payments on a $600,000 loan and would take the total increase since April last year to an extra $1310 a month or $15,720 a year. Even if a borrower has secured a 0.5% cut to their mortgage rate their payments would be up an extra $13,320 a year since April last year.

On the data front in Australia, expect March quarter GDP growth (Wednesday) of just 0.3%qoq or 2.4%yoy with a -0.6 percentage point detraction from net exports, flat dwelling investment, soft growth in consumer spending but a rise in business investment and public spending. The trade surplus (Thursday) is expected to remain high at around $14bn.

Outlook for investment markets

The next 12 months are likely to see easing inflation pressures and central banks moving to get off the brakes. This along with improved valuations should make for reasonable share market returns. But the next few months are likely to be rough given high recession and earnings risks, uncertainty around US banks and poor seasonality out to around September/October. This is likely to impact both global and Australian shares.

Bonds are likely to provide returns above running yields, as growth and inflation slow and central banks become less hawkish.

Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of last year’s rise in bond yields on valuations. Commercial property returns are likely to be negative as “work from home” hits space demand as leases expire.

With an increasing supply shortfall, we have revised up our national average home price forecast for this year from a fall of -7% to around flat to up slightly ahead of 5% growth next year. However, the risk is high of a further leg down putting us back on track for a 15-20% top to bottom fall on the back of the impact of high and still rising interest rates and higher unemployment.

Cash and bank deposits are expected to provide returns of around 3.5%, reflecting the back up in interest rates.

The $A is at risk of more downside in the short term, but a rising trend is likely over the next 12 months, reflecting a downtrend in the overvalued $US and the Fed moving to cut rates.

What you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.