US and European shares rose further over the past week helped by okay economic data and expectations for rate cuts this year. News from central bankers was mixed with Fed Governor Waller saying there is still no rush to cut rates (although he looks to be on the hawkish side at the Fed as not much has happened since last week’s meeting when the Fed was dovish), but ECB officials sounding dovish and the Swedish central bank flagging possible rate cuts in May or June. Japanese and Chinese shares fell for the week. Helped by the positive US lead and lower than expected local inflation, Australian shares rose around 1.6% for the week led by health, energy, consumer staple and property shares. Bond yields fell slightly. Commodity prices were mixed with oil and copper up but iron ore down slightly, The $A rose slightly and $US fell slightly.

After another strong month shares have had a very strong start to the year (with global shares up 9.8% and Australian shares up 3.9%) and with valuations stretched and investor sentiment high the risk of a share market correction remains high. But the economic news consistent with a Goldilocks scenario of continuing but cooler growth and falling inflation, with central banks remaining on track for rate cuts this year, is continuing to drive a rising trend in share markets which may keep any corrections mild. It’s also worth noting that the breadth of US share market gains has spiked (ie, the proportion of the market making new 52-week highs has risen) whereas major share market tops normally see months of falling breadth beforehand.

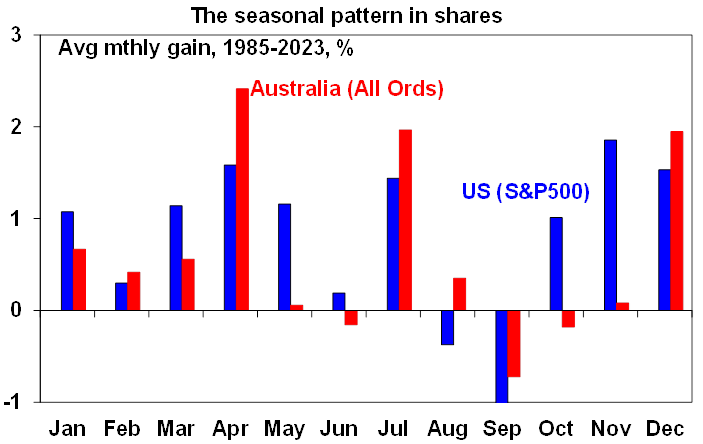

And the month of April is amongst the strongest seasonally both in the US and particularly Australia.

Source: Bloomberg, AMP

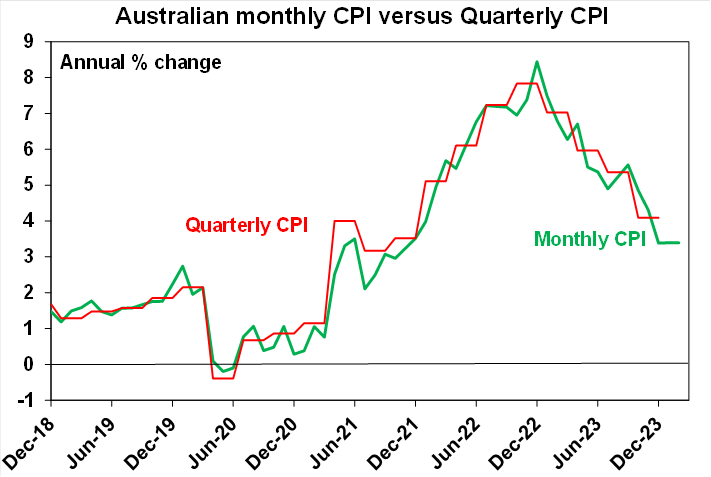

Australian inflation is continuing to surprise on the downside and is tracking below RBA forecasts. For the fifth month in a row monthly CPI inflation came in weaker than expected in February, with a monthly rise of just 0.2%mom and annual inflation unchanged at 3.4%yoy. While fuel and education costs rose sharply and housing costs continue to rise at a rapid rate this was offset in in the month by greater than expected weakness in costs for holiday travel (despite Swiftonomics boosting hotel prices in Sydney and Melbourne), utilities and many food items.

Source: ABS, AMP

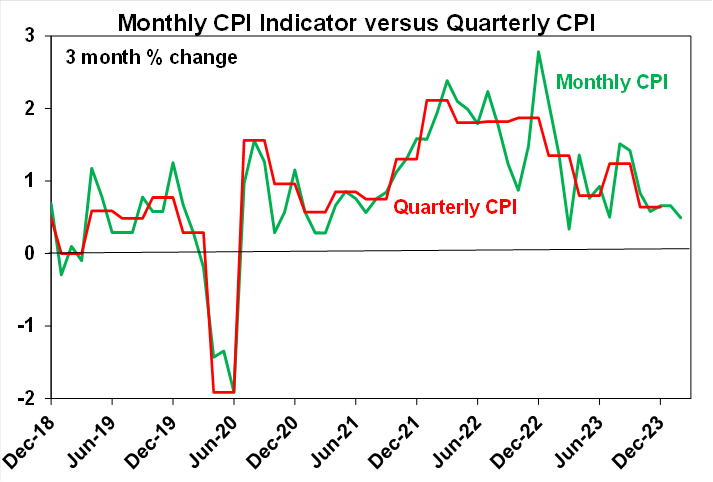

Trimmed mean and services inflation ticked up slightly, but March quarter inflation looks on track to be just 0.5%qoq or so, which will drop annual inflation to 3.2%yoy, which is well below the RBA’s forecast for 3.5%yoy. And on a six-month annualised basis inflation will have been just 2.2%, ie below target.

Source: ABS, AMP

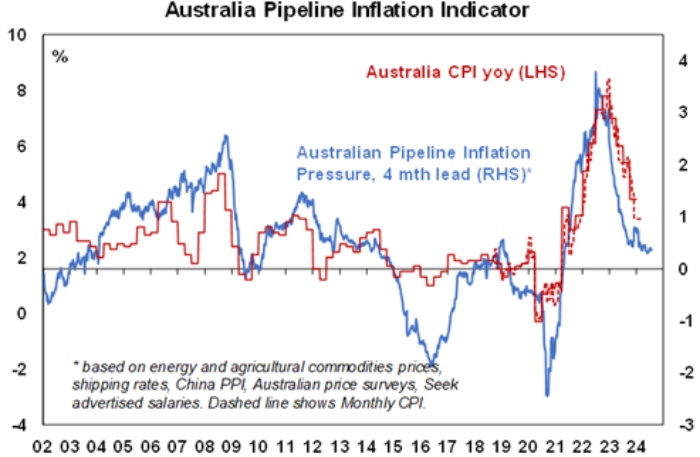

Our Australian Pipeline Inflation Indicator continues to point to a further fall ahead and in the September quarter we see inflation falling to just below 3%, 12 months ahead of the RBA’s forecasts.

Source: Bloomberg, AMP

The continuing faster than expected fall in Australian inflation provides support for our view that the RBA will start to cut rates from June. However, in the interim the RBA is likely to remain cautious and the risk remains high that the combination of the economy still growing, the stronger than expected labour market, upside risks to wages growth (flowing from another large increase in aged care workers wages and the upcoming minimum and award wage cases), along with the revamped Stage 3 tax cuts will see the start of rate cuts pushed back to August or September.

What happened to Swiftonomics? No big impact on inflation or retail sales. Taylor Swift’s Eras Tour was huge, and its impact can be seen in February inflation and retail sales data, but it was never going to be big enough to significantly boost the economy or lead to higher interest rates. Our estimate was that it would amount to just 0.02% of Australian GDP. So, as we have seen, both inflation and retail sales actually came in weaker than expected in February as Swiftonomics was swamped by other factors. And now we have to live with the hangover as the Swift lift was temporary.

Bad Easter news – get ready for surging chocolate prices! But don’t expect a big impact on inflation. Over the last year the price of cocoa has surged more than three-fold due to supply disruptions in Africa associated El Nino (hot dry weather and then flooding rains), pests and rising pesticide costs. As the basic ingredient in chocolate, it means higher chocolate prices although the full impact will take a while to show as many chocolate producers have long dated agreed price contracts for cocoa. That said it might be an idea to switch to carob for a while (although sugar prices are up too so it may also be affected). I am more a savoury person (Arnotts’ Shapes are my favourite) so I am not too fussed by higher chocolate prices. I hear savoury is also a healthier snack option than sweet. That said I doubt the coming surge in chocolate prices will have a significant impact on CPI inflation – chocolate has a very low weight in the Australian CPI (it’s only a portion of “snacks and confectionary” which has a total weight of just 0.89% in the CPI).

But won’t another big increase in Australian minimum and award wages just add to inflation? Sure, it’s a risk given the influencing effect they have on other wages, particularly if the Fair Work Commission grants unions’ request for a 5% rise coming on the back of last year’s 8.65% and 5.75% rises respectively for minimum and award wages. But if its in line with inflation (say 3.5-4%) as the Government appears to be supporting its unlikely to have an inflation threatening effect on wages growth and would be consistent with both slowing down this year.

I may not be a heavy metal sort of guy (more pop) but I know a good heavy metal band when I hear one and ACDC is about the best. Its now 50 years ago since Bon Scott joined ACDC and the combination took them to global super stardom. The clip of them going down Swanston Street performing It’s A Long Way To The Top is an absolute classic. Brian Johnson as Bon’s replacement helped keep the magic going. Here’s Thunderstruck.

Economic activity trackers

Our Economic Activity Trackers are still not showing anything decisive, although they have improved a bit in Australia recently.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence and credit & debit card transactions. Source: AMP

Major global economic events and implications

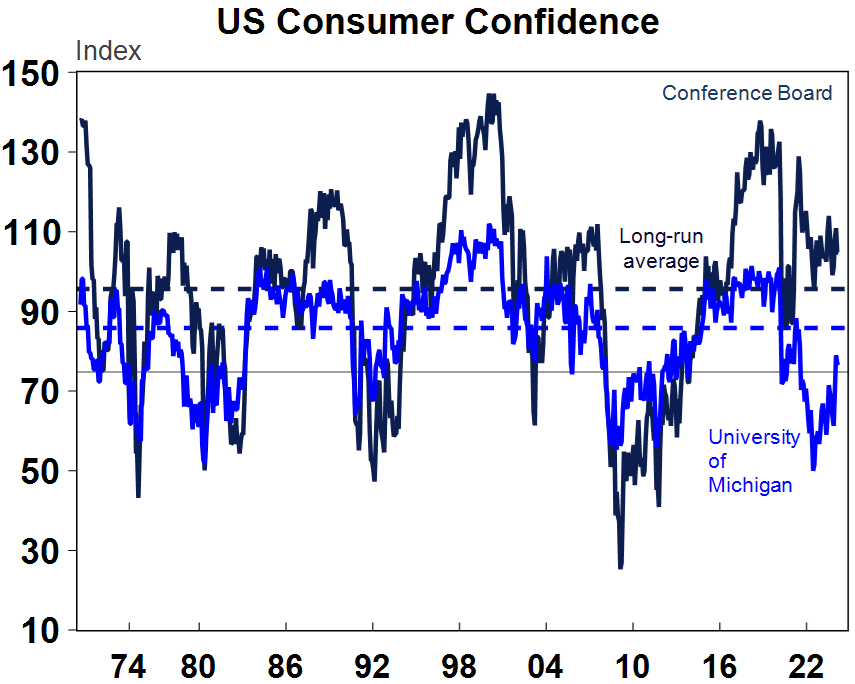

US economic data was mixed over the last week. Durable goods orders rose strongly in February but this followed a sharp fall in January. Underlying capital goods orders and shipments are continuing to see a very modest rising trend. The Conference Board’s measure of consumer confidence fell slightly but remains above average levels with the University of Michigan measure (which has a greater weight to financial conditions) remaining somewhat weaker. Meanwhile, although annual home price growth is running around 6%yoy, monthly growth has moderated to around zero.

Source: Macrobond, AMP

Baltimore bridge collapse and port closure – another supply shock? This was a horrible disaster and the closure of Baltimore port and breakdown in a key east coast road will disrupt transport. But its unlikely to be significant for the US as a whole. Baltimore is the largest US port handler for autos where delays are likely, but in total it handles only 1.6% of US water borne trade much of which can be re-routed to other East Coast ports until the port is reopened.

Eurozone economic confidence rose in March helped by gains in business and consumer sentiment, but refmains softish.

The Swedish central bank looks to be another central bank heading towards rate cuts, likely in May or June. It left its key policy rate on hold at 4% but noted “forward looking indicators imply [inflation is] approaching 2%.”

Australian economic events and implications

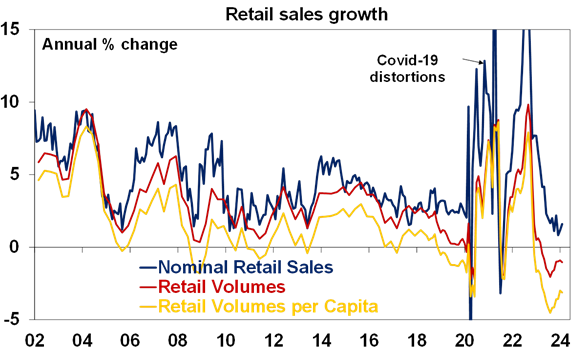

Retail sales remain very weak. While there may have been a “Swift lift” to spending on clothing, merchandise and hospitality, retail sales rose by less than expected in February, are up just 1.6%yoy (or down about 0.9%yoy per person) and outside of the boost from Taylor underlying retail sales were up just 0.1%mom and the trend is stagnant. So February would likely have been even softer without the boost from Taylor Swift’s tour, but the boost was only temporary so expect some payback with a likely fall in retail sales in March.

Source: ABS, AMP

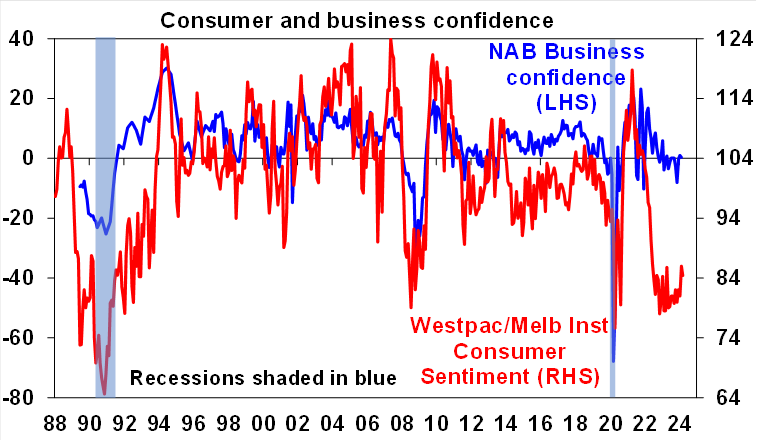

Meanwhile Australian consumer confidence remains weak. It fell slightly in March with responses once again weaker when taken before the last RBA meeting, where it remained in no hurry to cut rates, than after. Clearly high interest rates are still weighing on consumer confidence, particularly relative to business confidence, with many hoping for rate cuts soon.

Source: Westpac/MI, AMP

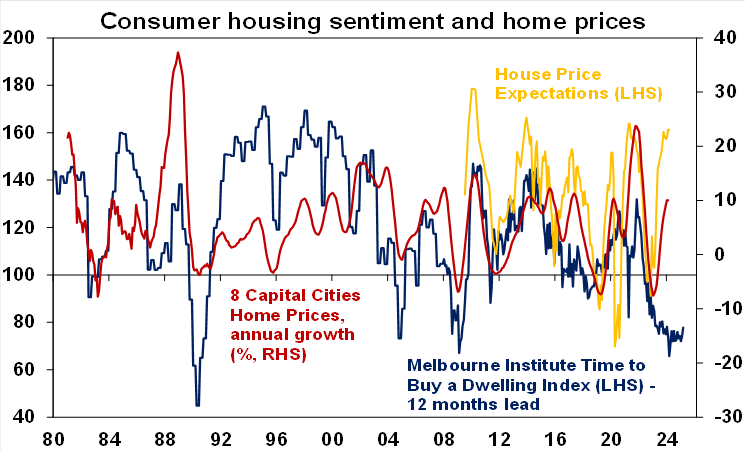

Perceptions regarding whether it’s a good time to buy a dwelling or “save” in real estate improved slightly…but remain very weak. Consumers remain cautious still favouring bank deposits or paying down debt as the “wisest place for savings” over shares, property or superannuation.

Source: Westpac/MI, CoreLogic, AMP

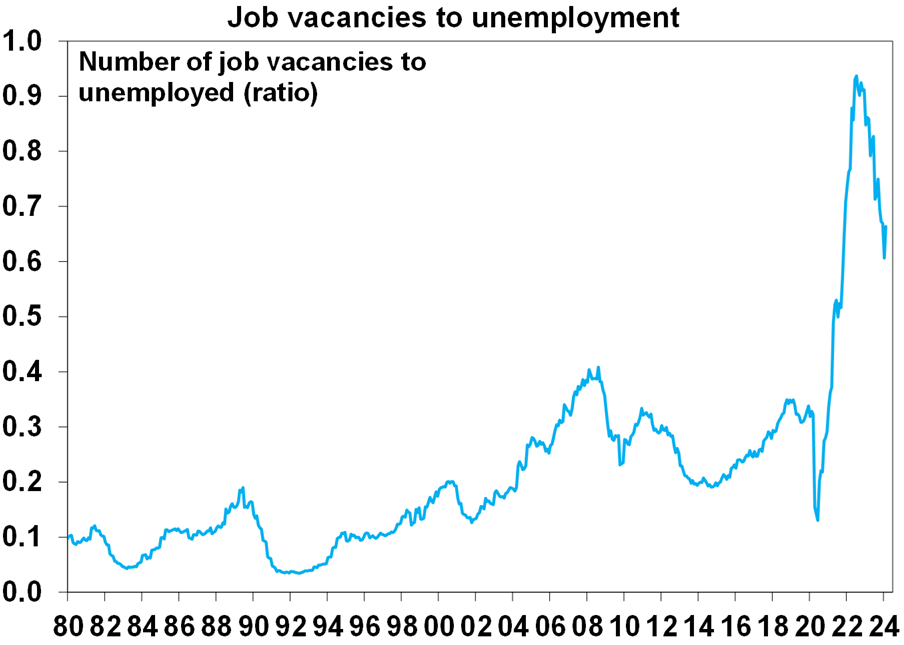

The labour market is continuing to cool – job vacancies fell for the seventh quarter in a row in February. They are still high relative to unemployment indicating the jobs market remains tight but its cooling which will take pressure off wages growth.

Source: ABS, AMP

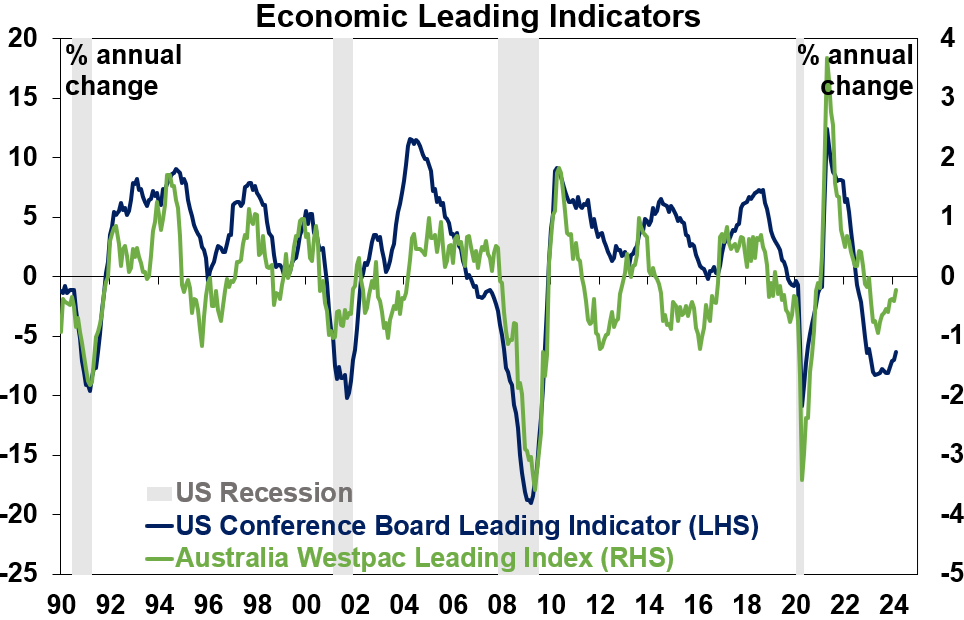

A stabilisation in Australia’s leading economic index, similar to that in the US, provides some confidence recession will be avoided. Leading indexes are combinations of economic variables, like confidence and housing approvals, known to lead the economic cycle.

Source: Bloomberg, Westpac/MI, AMP

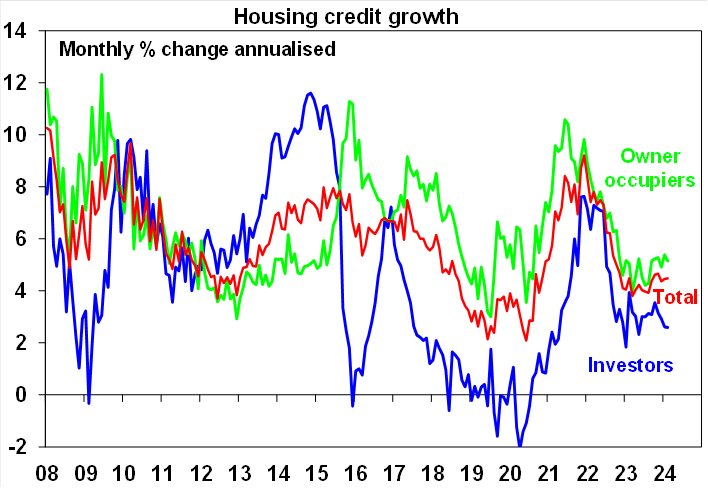

Credit growth remains moderate. February data showed that growth in housing credit remains well down from the last big property price upswing into 2022 reflecting much lower property sales volumes this time around, more cash only transactions (and likely also more “bank of mum and dad” financing) and recent price strength coming in lower priced cities.

Source: ABS, AMP

Finally, Federal budget data for the financial year to date to February is tracking about $1bn better than expected in December suggesting its on track for a small surplus, or if it tracks the profile for the last financial year for the next few months it could turn into another fairly sizeable surplus. Higher than forecast commodity prices and hence corporate tax revenue remain a key driver.

What to watch over the next week?

In the US, the focus will be on jobs data (Friday) which is expected to show a solid but slower 215,000 gain in payrolls, unchanged unemployment at 3.9% and average hourly earnings growth remaining around 4.3%yoy. In other data expect the March ISM manufacturing conditions index (Monday) to remain around a weak 48 and the ISM services conditions index (Tuesday) to remain around an okay 52.6 and job openings (Tuesday) to remain in a downtrend.

In Europe expect March inflation data to come in around 2.6%yoy with core inflation falling to 3%yoy. February unemployment is expected to be unchanged at around 6.4%yoy (both due Wednesday).

The Japanese March quarterly Tankan business conditions survey will be released Monday.

Chinese business conditions PMIs for March (due Sunday, Monday and Wednesday) will likely remain softish but consistent with continued economic growth around 4.5% to 5%.

In Australia, the minutes from the RBA’s last meeting (Tuesday) will be watched closely for more detail around its move to a neutral bias on interest rates. On the data front expect March Core Logic data (Tuesday) to show another 0.6% rise in home prices, building approvals (Thursday) to bounce 2% after falls in the prior months and the trade surplus (Friday) to fall back to $10.5bn.

Outlook for investment markets

Easing inflation pressures, central banks moving to cut rates and prospects for stronger growth in 2025 should make for good investment returns this year. However, with a high risk of recession and investors and share market valuations no longer positioned for recession and geopolitical risks, it’s likely to be a rougher and more constrained ride than in 2023.

We expect the ASX 200 to return 9% this year and rise to around 7900. This is now looking conservative. A recession is probably the main threat.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows, and central banks cut rates.

Unlisted commercial property returns are likely to be negative again due to the lagged impact of high bond yields & working from home.

Australian home prices are likely to see more constrained gains compared to 2023 as still high interest rates constrain demand and unemployment rises. The supply shortfall should provide support though and rate cuts from mid-year should help boost price growth later in the year.

Cash and bank deposits are expected to provide returns of over 4%, reflecting the back up in interest rates.

A rising trend in the $A is likely taking it to $US0.72, due to a fall in the overvalued $US & the Fed cutting rates by more than the RBA.

What you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.