Global share markets mostly fell over the last week with more hawkish commentary from Fed Chair Powell and worries that problems at two regional US lenders may mean wider issues for banks. This saw US shares fall 4.6% for the week giving up most of their gains for the year to date and Eurozone shares fell 1.8%. Chinese shares also fell 4% but the Japanese share market rose 0.8%. While Australian shares were initially boosted by a less hawkish RBA they succumbed to the global weakness to be down around 1.8% for the week with falls in resources, health and financial shares leading the declines. Bond yields mostly fell helped partly by safe haven demand and in Australia by less hawkish RBA commentary. Oil and metal prices also fell, but the iron ore price rose. With a more hawkish Fed and less hawkish RBA the $A fell as the $US rose.

Are we going to see broader systemic problems in US banks? The collapse or closure of two regional US lenders – Silicon Valley Bank which landed to tech start-ups and Silvergate Capital which was a crypto friendly lender have led to concerns that they may reflect the start of broader problems in the US banking system. This is quite possible as Fed rate hike cycles by tightening financial conditions invariably trigger financial stresses (think the tech wreck and GFC) and troubles in start up companies and crypto businesses and nervous depositors in banks who fund them are not that surprising in this environment and given what’s happened to crypto over the last year. At this stage its too early to tell if problems at these lenders reflect just isolated problems or are indicative of wider potential problems impacting the US banking system. Either way banks are likely to see a tougher environment ahead as growth slows and higher rates cause more financial stress for borrowers. And it is a sign that Fed tightening has got traction and the Fed may be close to the top on rates.

Fed Chair Powell confirms the Fed has becomes more hawkish in the last month. This reflects the recent run of stronger than expected economic data with inflation falling more slowly than previously indicated. As a result, Powell indicated that the peak level of interest rates is likely to be higher than previously expected and if warranted the Fed is prepared to step up the pace of rate hikes again. At its December meeting the Fed dot plot of officials’ interest rate expectations indicated a peak of 5-5.25% but this now looks likely to move up to 5.25-5.5% at this month’s meeting. Providing the totality of data for job openings, payrolls, inflation and retail sales is cooler then the Fed will stick to a 0.25% hike at its 22nd March meeting, with Powell also noting that the slower pace of rate hikes enables it to better assess the lagged impact of past hikes. If the data is mostly still strong then it’s likely to step up to +0.5% again. So far job openings and payrolls data has been mixed. Job openings remained high in January but fell slightly and quits fell and layoffs rose. And while payrolls were stronger than expected for February at 311,000 they slowed, prior months were revised down, participation rose and wages growth was slower than expected. As a result, so far the data has been mixed and with the Fed likely to be wary following the regional bank failures its likely to stick to a +0.25% hike at its next meeting, rather than move back to 0.5%. If news regarding banks darkens further it may even hold.

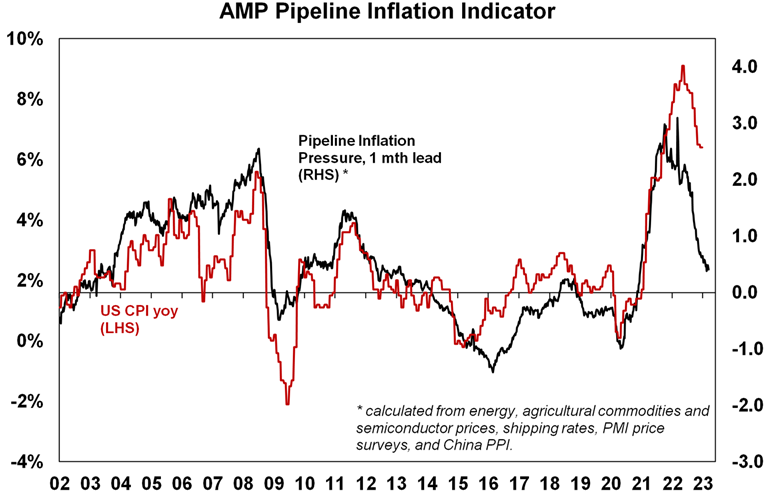

More broadly, our view is that the US economy will continue to slow – with most leading indicators including the yield curve still pointing down – and that this will flow through to a further slowing in inflation – with our Pipeline Inflation Indicator continuing to point down. Ultimately this should enable the Fed to stop tightening before triggering a deep recession, albeit the odds of a mild recession are high. And given the uncertainties share market volatility is likely to remain very high.

Source: Bloomberg, AMP

Out of interest Powell also observed that the neutral rate of interest may be higher than the 2.5% the Fed has been assuming since 2019 and a return to the low pre pandemic bond yields does not look likely. None of this should really be surprising though as with the world now entering a more inflation prone environment – with bigger more interventionist governments, a reversal of globalisation & rising geopolitical tensions – the multi decade downtrend in bond yields is likely well and truly over and the neutral Fed Funds rates is likely higher than 2.5% (back in 2015 the Fed assumed it was 3.5%). This means the long-term tailwind for investment returns pre pandemic from the downtrend in interest rates and bond yields is likely over.

It was a different story at the Bank of Canada, which left interest rates on hold at 4.5%. This was flagged by the BoC back in January and reflects softer economic data lately and a rollover in inflation since mid last year. Its looking like interest rates in Canada may be at or close to the peak with the money market assuming less than another 0.25% hike.

It was also a different story at the RBA, which in contrast to the Fed has become less hawkish. As expected, the RBA increased the cash rate by another 0.25% taking it to 3.6%. But thanks to a run of softer economic data the RBA wound back its hawkishness from last month that followed the stronger than expected December quarter inflation data. While its still hawkish and repeated its message on the need to get inflation down, it acknowledged recent data that showed slowing growth, some easing in the jobs market, signs of a peak in inflation and reduced risk of a wages breakout. As such it toned back its guidance on the expected outlook for interest rates from several more rate hikes to maybe just one more and opened to door to a pause in rates with Governor Lowe noting that “with monetary policy now in restrictive territory, we are closer to the point where it will be appropriate to pause interest rate increases to allow more time to assess the state of the economy.”

Of course, just as with the “no rate hikes expected until 2024” guidance nothing is set in stone & where rates peak is data & outlook dependent. We see a strong case for a pause in rate hikes given the signs of slowing demand, improving supply conditions, the increasing pain being born by mostly younger households with mortgages, the absence of a wages breakout and contained longer term inflation expectations. We are concerned that ongoing rate hikes risk unnecessarily plunging the economy into a recession. As such its time for the RBA to have a pause and we are assuming a pause at their April meeting. While we have been way too optimistic on how far rates would rise and the risks are still on the upside, our view remains that we are at or near the top and that by late this year or early next the RBA will start cutting rates. Indeed, Governor Lowe has indicated he is “open” to a pause in April but he made it conditional on upcoming data for jobs (16 March), retail sales (28 March) and monthly inflation (29 March) along with business surveys “collectively…suggest[ing] that the right thing to do is pause”.

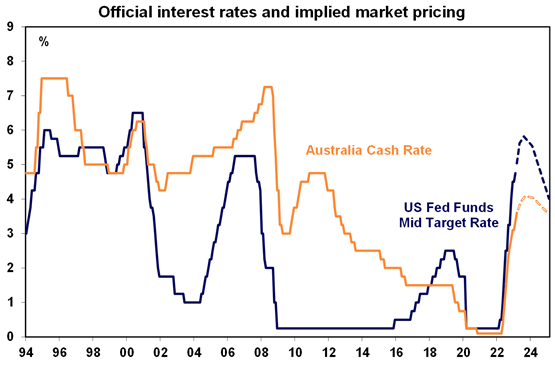

The divergent Fed and RBA commentary over the last week highlights the divergence in interest rates between the two countries – with the Fed Funds rate at 4.5-4.75% and now maybe on its way to 5.5% and the RBA’s cash rate at 3.6%. While the RBA seemed to be questioning whether this gap was justified at its February meeting, Governor Lowe was justifying it in the past week noting that it reflects lower wages growth and the high reliance on variable mortgage rates in Australia. As we noted last week the run of weaker data in Australia is consistent with this.

Source: Bloomberg. AMP

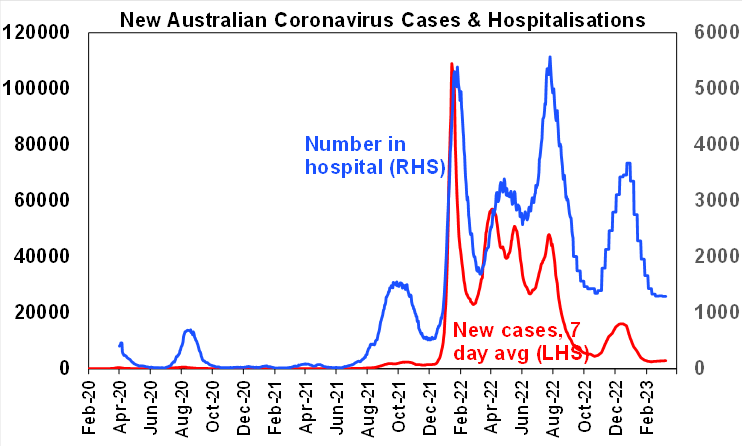

Coronavirus update

New global Covid cases and deaths continue to trend down. New cases in Australia have increased slightly with NSW up for three weeks in a row – but it’s from a low base.

Source: covidlive.com, AMP

Economic activity trackers

Our Economic Activity Trackers fell again in the US & Australia over the last week but rose in Europe which continues to hold up well. They are still not indicating economic collapse.

Levels are not really comparable across countries. Based on weekly data for eg job ads, restaurant bookings, confidence, credit & debit card transactions and hotel bookings. Source: AMP

Major global economic events and implications

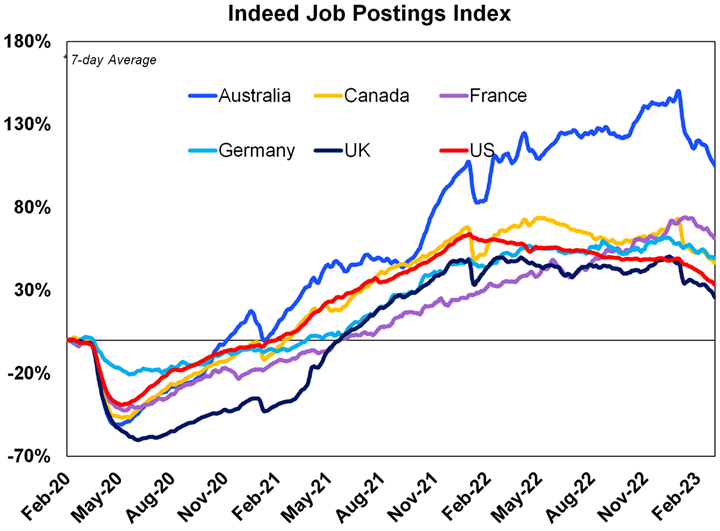

US labour market indicators were mixed. February payrolls rose a more than expected 311,000, but slowed from January with prior months revised down & unemployment rose to 3.6% with increased participation and wages growth slowed to just 0.2%mom. January job openings fell back but only slightly and remain 1.9 times the level of unemployment which suggests the jobs market remains tight. Against this though, Indeed job postings are continuing to fall in the US (and in Australia and other countries) and workers quitting for other jobs continue to trend down albeit from a high base and layoffs continue to trend up albeit from a low base. Jobless claims rose although this might be due to bad weather and seasonal adjustment problems and of course they are still low. On balance, the jobs market might be turning softer but right now it’s still tight which will keep the Fed hiking, albeit the past week’s data was probably not enough to tip them back into +0.5% hikes.

Source: Macrobond, AMP

Source: Bloomberg, AMP

Eurozone 3-year consumer inflation expectations fell back to 2.5% in January which is good news for the ECB as its roughly consistent with their 2% target and means as with the Fed that they should not have to get really aggressive in raising interest rates. In other words, this is not like 1980 in the US after which inflation expectations had become high and entrenched making it a lot harder to get inflation back down.

The Bank of Japan at Governor Kuroda’s final meeting left monetary policy unchanged. Kuroda leaves after a decade having broken the back of deflation and very low inflation but with core inflation still just below 2% and wages growth weak its still not clear that inflation will be sustained at the 2% target beyond the current global inflation outbreak. New Governor Ueda will probably start the process of unwinding yield curve control but his comments so far have been patient and dovish and when he does start to move it will probably come as a surprise which means many months away. On the data front, wages growth slowed back to just 0.8%yoy, from 4.1%yoy in December when it was boosted by bonuses. This makes it harder to be confident that inflation will be sustained at target once energy and food price pressures recede. Producer price inflation also fell to 8.2%yoy in February, from 9.5%.

China’s National People’s Congress set a softer than expected growth target of 5% for this year. I wouldn’t make too much of this though – while it implies less stimulus than many are expecting it may have also been set such that its easier for the Government to beat. Particularly after last year targeting 5.5% and then underachieving thanks to Covid restrictions with 3% growth. Our assessment remains that the reopening boost will drive Chinese growth of around 6% this year. On the data front inflation fell in February to just 1%yoy for CPI inflation, 0.6%yoy for core CPI inflation and to -1.4%yoy for producer price inflation. Its likely to rise this year with reopening but may not exceed the Government’s 3% target. Meanwhile trade data for January/February showed continuing weak exports and imports but money supply and credit data for February were stronger than expected with total credit growth rising from 9.4%yoy to 9.9%yoy.

Australian economic events and implications

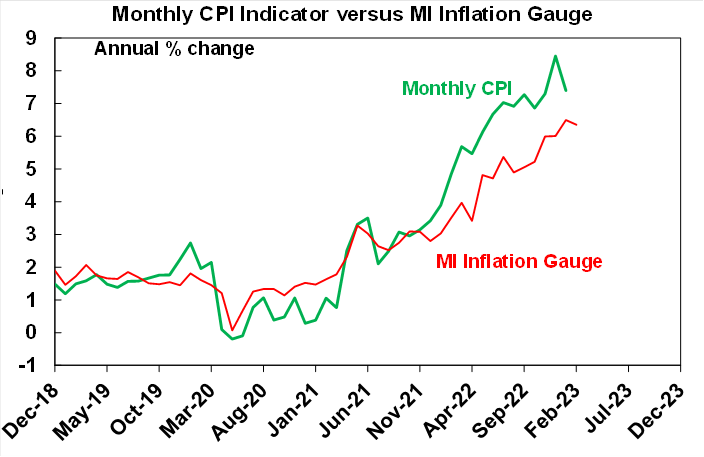

In Australia, the Melbourne Institute’s Inflation Gauge for February slowed slightly to 6.3%yoy, but its been undershooting the ABS’s quarterly and monthly inflation measures for a while.

Source: Melbourne Institute, ABS, AMP

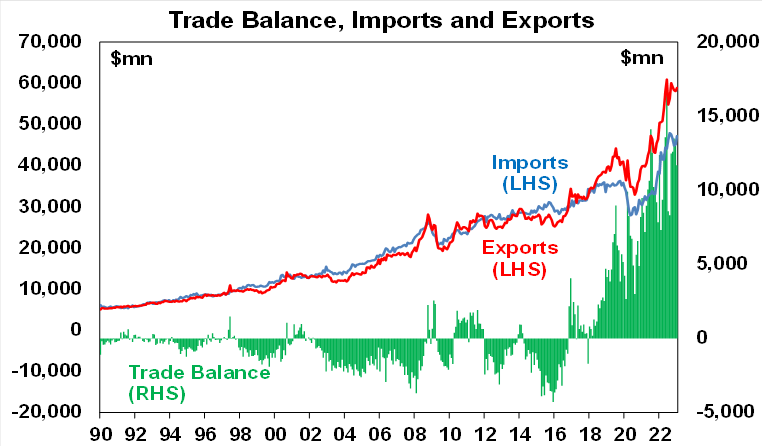

Meanwhile, the January trade surplus fell but to a still high $11.7bn due to a surge in imports partly reflecting a rapid rebound in outbound tourism. Exports remained strong with strength in iron ore & meat offsetting price falls for coal and gas.

Source: ABS, AMP

What to watch over the next week?

In the US, the focus will be on inflation and retail sales data for February which will likely influence whether the Fed will revise up its peak rate guidance and/or step up rate hikes at its next meeting. The CPI (Tuesday) is expected to rise 0.4%mom or 6%yoy which is down from 6.4%yoy in January. Core CPI inflation is expected to edge down to 5.5%yoy from 5.6%. Producer price inflation (Wednesday) is also expected to have slowed to 5.4%% from 6%yoy. In other data expect a sharp slowing in retail sales growth and some fall back in the NAHB builders index (Wednesday), flat housing starts (Thursday) and a rise in industrial production (Friday). Manufacturing conditions indexes for the New York and Philadelphia regions are likely to have remained soft.

The ECB (Thursday) is expected hike its policy rates by another 0.5% taking its main refinance rate to 3.5% and signal more hikes to come particularly with core inflation continuing to rise.

Chinese industrial production and retail sales data for January/February (Wednesday) are expected to show a significant acceleration following reopening.

In Australia, the focus will be on jobs data (Thursday) and on consumer and business confidence (Tuesday). We expect employment to rebound by 70,000 following the impact of seasonal distortions in December and January that saw more people than normal indicating that they had a job to go to but were not in employment or looking for work. This is likely to also result in a rebound in participation such that while the unemployment is likely to edge back to 3.6% but still be up from its November low of 3.4%. Consumer confidence for March might improve slightly following less hawkish RBA commentary but its likely to remain around recessionary levels. The February NAB business survey is likely to see weaker confidence and conditions.

Outlook for investment markets

The year ahead is likely to see easing inflation pressures, central banks moving to get off the brakes and economic growth weakening but stronger than feared. This along with improved valuations should make for better returns than in 2022. But there will be bumps on the way – particularly regarding interest rates, recession risks, geopolitical risks and raising the US debt ceiling in the September quarter.

Global shares are expected to return around 7% this year. The post mid-term election year normally results in above average gains in US shares, but US shares are likely to remain a relative underperformer compared to non-US shares reflecting still higher price to earnings multiples versus non-US shares. The $US is also likely to weaken which should benefit emerging and Asian shares.

Australian shares are likely to outperform again, helped by stronger economic growth than in other developed countries and stronger growth in China supporting commodity prices and as investors continue to like the grossed-up dividend yield of around 5.5%.

Bonds are likely to provide returns a bit above running yields, as inflation slows and central banks become less hawkish.

Unlisted commercial property and infrastructure are expected to see slower returns, reflecting the lagged impact of weaker share markets and last year’s rise in bond yields (on valuations).

Australian home prices are likely to fall another 8% or so as rate hikes continue to impact, resulting in a top to bottom fall of 15-20%, but with prices expected to bottom around the September quarter, ahead of gains late in the year as the RBA moves toward rate cuts.

Cash and bank deposits are expected to provide returns of around 3.25%, reflecting the back up in interest rates through 2022.

A rising trend in the $A is likely over the next 12 months, reflecting a downtrend in the overvalued $US, the Fed moving to cut rates and solid commodity prices helped by stronger Chinese growth.

What you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.