Key points

– Capital city property prices so far in March are on track for a 0.6% or so gain, led by Sydney, based on CoreLogic data.

– The main positives for the residential property market are improving demographic demand, constrained supply and tight rental markets.

– Against this the full impact of interest rate hikes is yet to be seen with home buyer capacity remaining well down.

– As such, while there is a chance that prices have bottomed, our base case remains for a 15-20% top to bottom fall in prices with the current bounce likely to be short lived.

The bounce in home prices

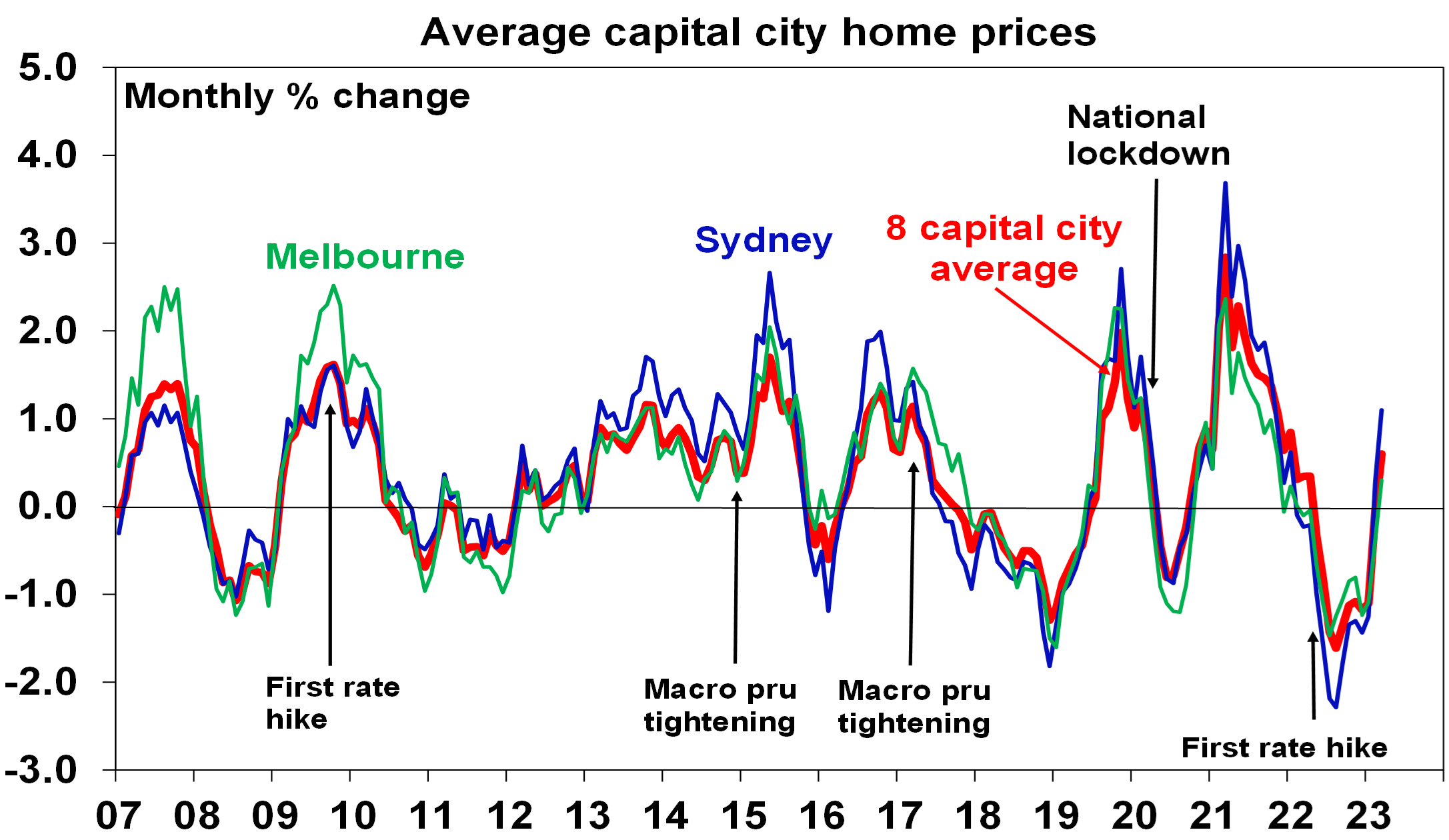

From their high in April to their low last month national average home prices have fallen 9.1% making it their biggest fall in CoreLogic records going back to 1980. Capital city average prices were down 9.7% which is their second biggest fall, after the 10.2% fall in 2017-19. However, average price falls had slowed to a crawl and CoreLogic data shows that this has morphed into price gains across several cities so far in March with Sydney prices tracking up 1.1% at a monthly rate and five capital city average prices tracking up 0.6%. See the next chart. If home prices have bottomed this would leave them short of our expectation for a 15-20% top to bottom fall. So are property prices doing it again? – falling less than expected and then rising more than expected. This note looks at the positives and negatives for the residential property market outlook.

Source: CoreLogic, AMP

The positives for the property market

Here are the main positives for the property market.

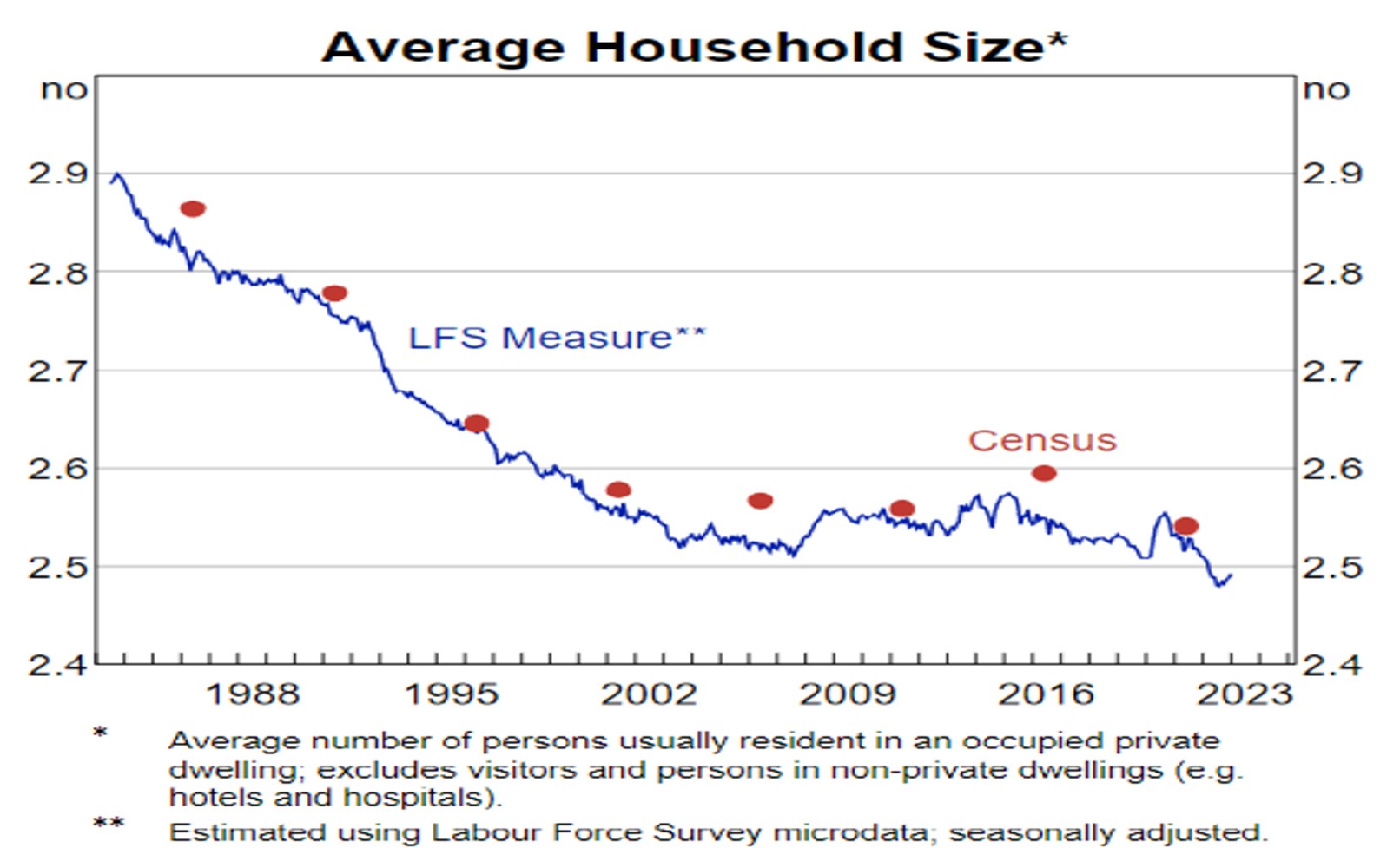

- RBA analysis shows a decline in household average household size since the start of 2020 of around 1%, which it estimates has added around 120,000 households to underlying dwelling demand partly offsetting the negative impact on demand from the hit to immigration through the pandemic lockdown.

Source: RBA Bulletin, March 2023, based on ABS data

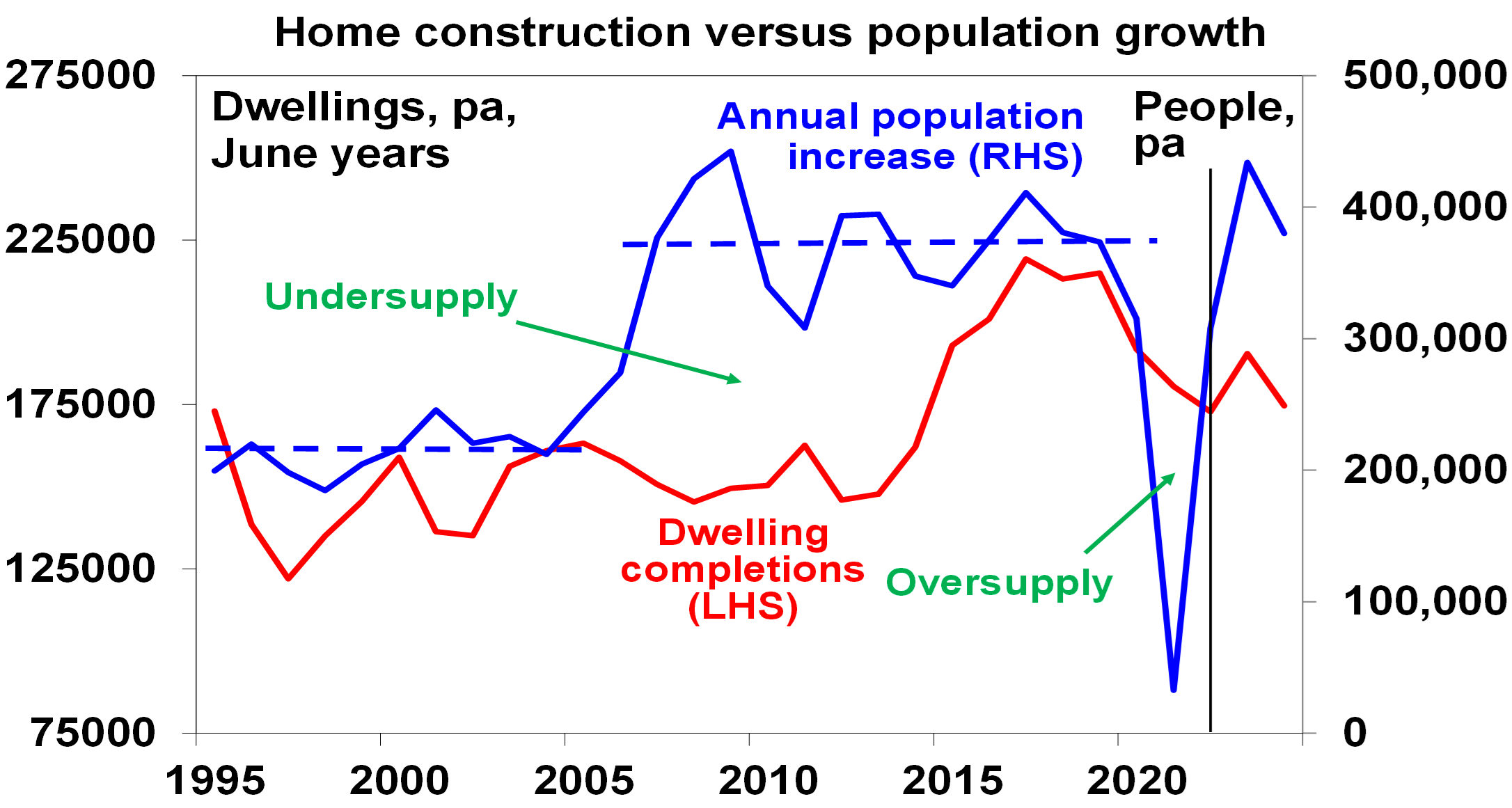

- Immigrants are returning boosting underlying demand for housing. Net immigration was around 320,000 last year up from just 5940 in lockdown impacted 2021. This roughly equates to demand for an extra 125,000 dwellings. Its likely to remain strong this year. This is seeing a rise in the cumulative undersupply of housing again.

Source: ABS, AMP

- Partly reflecting this, capital city rental vacancy rates below 1% are driving a surge in rents. This should be positive for investor demand.

- Allowing first home buyers to opt for land tax in NSW and other government support programs will be boosting demand.

- Listings are very low, running around 25-30% down on a year ago.

- Our assessment is that we are at or close to the top on interest rates and the problems in global banks add support to this assessment.

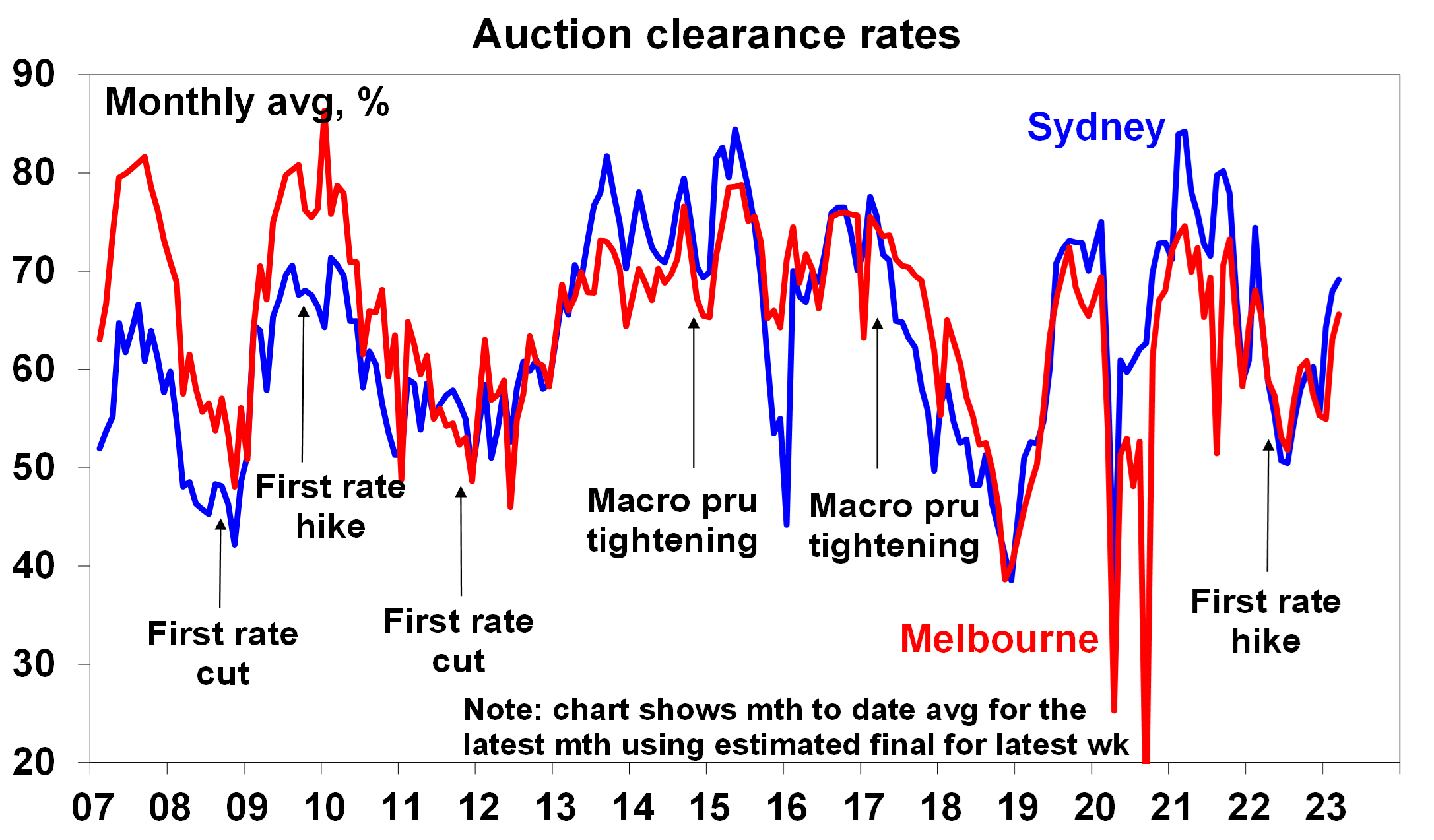

- Auction clearance rates have improved from their lows, and they usually have a directional correlation with home prices.

Source: Domain, AMP

So maybe the combination of bargain hunters motivated by the historical record that shows prices rebounding quickly, low listings, backed by expectations for strong demand as immigrants return are driving a recovery in prices. More fundamentally, the ongoing supply short fall provides some sort of floor under prices.

The negatives for the property market

However, the headwinds facing the property market are significant:

- The full impact of variable rate hikes has yet to be fully felt as it takes 2-3 months for RBA hikes to show up in actual mortgage payments;

- Roughly 880,000 fixed rate loans will expire this year which will see mortgage rates reset from around 2% to around 5 or 6%. RBA analysis indicates that while fixed rate borrowers may have similar liquid assets to variable rate borrowers they have higher risk characteristics;

- While we think rates are at or close to peaking numerous economists still see the cash rate rising above 4%;

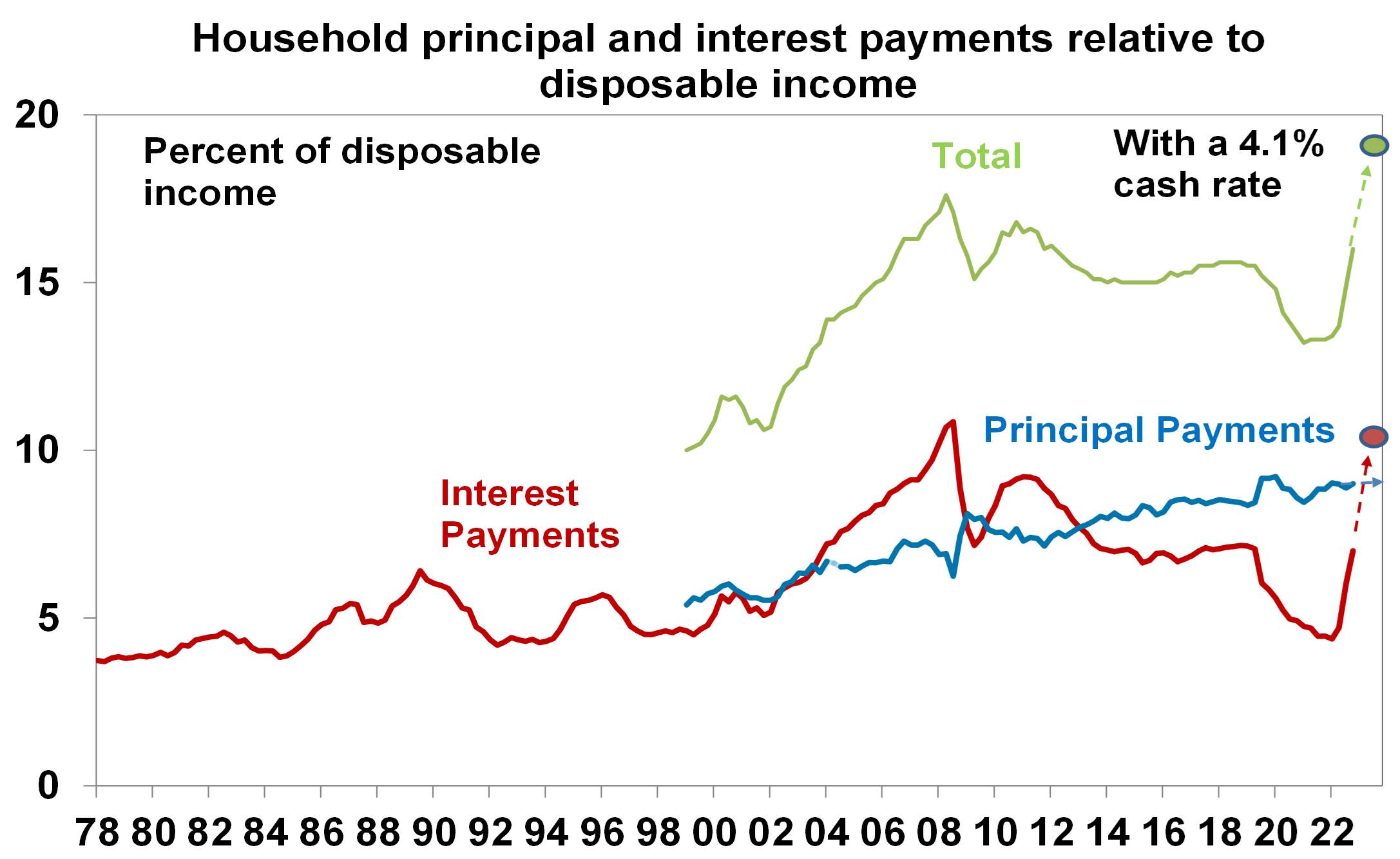

- Household debt servicing payments as a share of income have already risen to their highest in more than a decade resulting in a large squeeze on household cashflows but will rise further given the lagged flow through of variable rates and the fixed rate reset. A rise in the cash rate to 4.1% would see them pushed to record levels. This will remove roughly 5% of household cashflow in relation to income.

Source: ABS, BIS, AMP

- Australian economic conditions will deteriorate this year as weaker global growth impacts demand for our exports, rate hikes bear down on domestic demand as pent up demand from the pandemic is exhausted & this all combines to push up unemployment. Higher unemployment will likely add to mortgage stress.

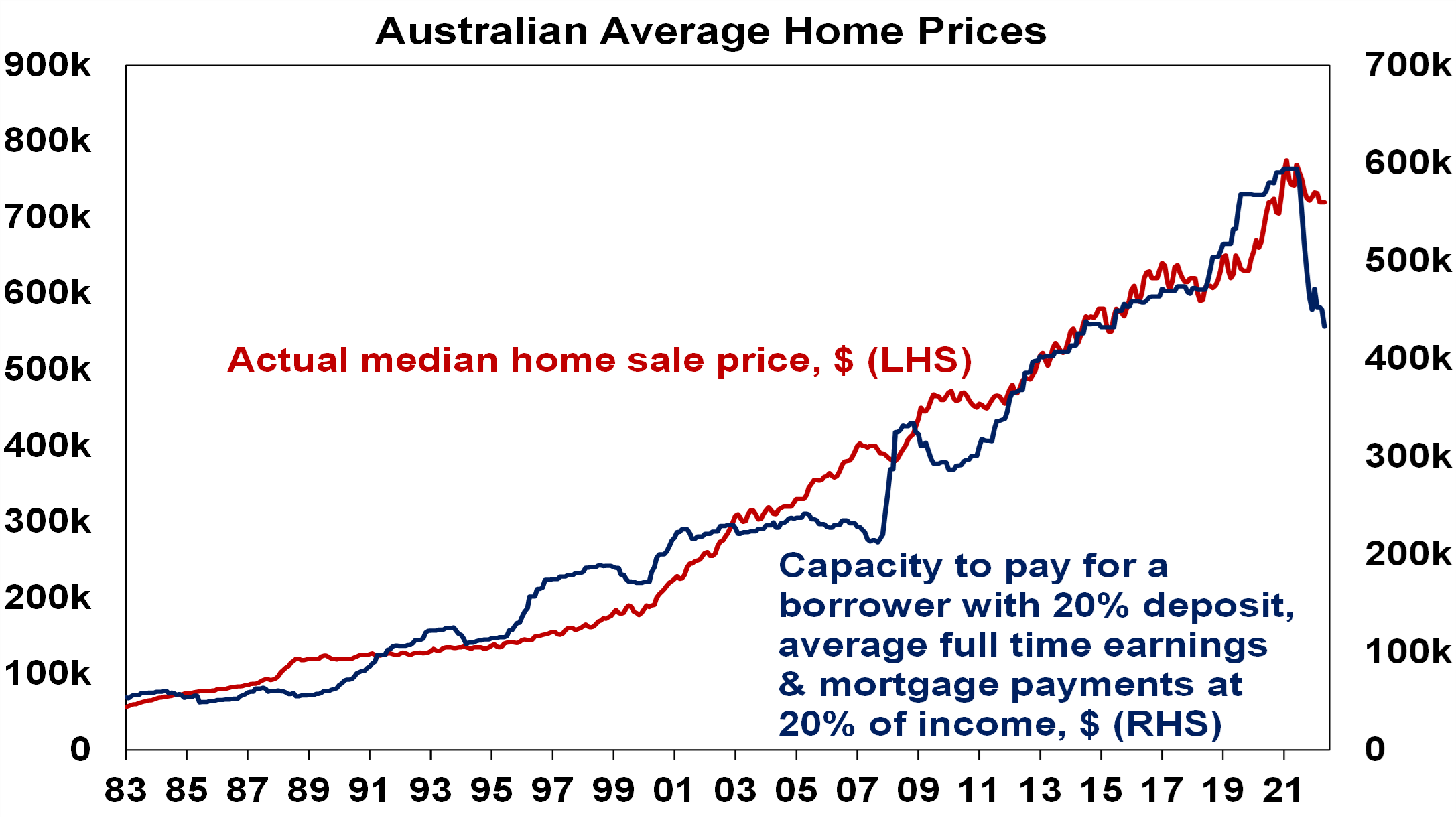

- The hit to home buying capacity from rate hikes – of around 27% for a buyer with a 20% deposit and average full-time earnings – remains even if rates have stopped rising. See the next chart.

Source: RBA, CoreLogic, AMP

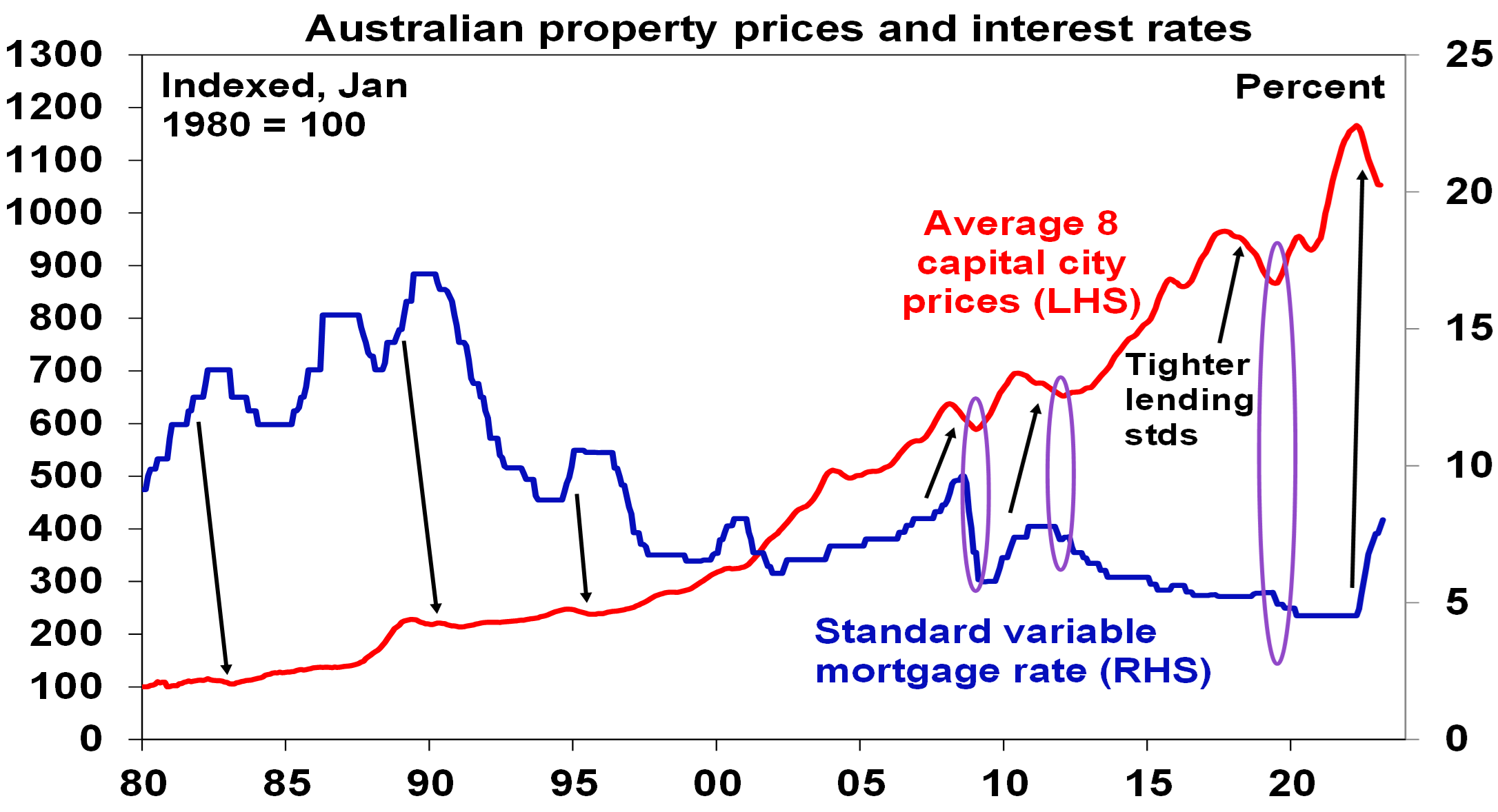

- Property down cycles into 2009, 2012 and 2019 only saw prices sustainably bottom once interest rates started falling. See the purple ovals in the next chart. And rate cuts are still a way off yet.

Source: CoreLogic, RBA, AMP

The combination will likely constrain demand and cause a potential increase in supply as some financially stressed homeowners sell.

Our base case

Our base case remains that the current bounce in home prices will be short lived as demand from bargain hunters runs its course, the impact of higher interest rates reasserts itself and listings increase in response to distressed selling. So we continue to see average home prices having a top to bottom fall of 15-20% to later this year of which we are half way through, and we don’t see a sustained recovery until next year.

While Australia’s fundamental housing shortage is now reasserting itself again – with rising underlying demand on the back of returning immigration and insufficient supply as evident in very low rental vacancy rates – it was the shift to ever lower interest rates over many years into the pandemic that allowed the supply shortfall to drive ever higher home price to income ratios over the last few decades. Now higher interest rates make this more difficult suggesting that the supply shortfall should take place at lower price to income ratios.

However, the current environment is very hard to read, so there is a chance that prices have bottomed, particularly if rates have peaked and if the Australian economy has a soft landing. But even if this is the case, in the absence of much lower interest rates the recovery is likely to be constrained as buyer capacity to pay for homes will be constrained.

What you need to know

While every care has been taken in the preparation of this article, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent AMP. This article is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

The information on this page was current on the date the page was published. For up-to-date information, we refer you to the relevant product disclosure statement, target market determination and product updates available at amp.com.au.